Two-third of the 9500 NBFCs are uncovered to the automotive sector. This means the magnitude of the disaster. They finance 75%-80% of recent business automobiles, 70% of recent two-wheelers and 50-55% of recent automobiles within the nation. Greater than half of the automobiles offered in rural markets are financed by NBFCs.

One other dimension of this drawback is that the majority of those firms cater to casual and self-employed debtors. And they’re the worst affected by the current disaster as they’re unable to service their loans. Consequently, the money flows for these firms are disrupted. However they’ve clients ready to be catered to although in fewer numbers than within the earlier years.

In comparison with the pre-pandemic days NBFC mortgage reimbursement collections have fallen by 15%-20% whereas their disbursement price has reached solely 65%-70% due to the lowered car gross sales.

The general wholesale of automobiles throughout FY21 throughout classes, together with passenger automobiles, two-wheelers and business automobiles, declined 13.60% to 18,615,588 items as in opposition to 21,545,551 items within the earlier 12 months, in response to knowledge launched by the Society of Indian Car Producers (SIAM).

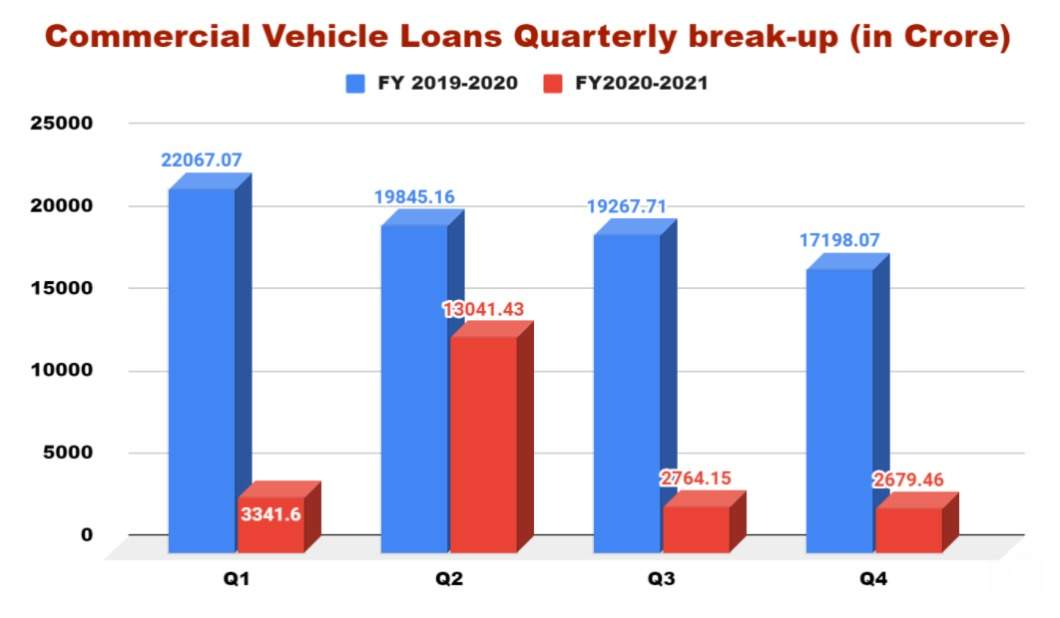

As car gross sales ebbed, NBFCs that are the key lenders to the auto sector have seen a steady downtrend in mortgage demand. For the FY 2020-2021, sanctions of car loans from NBFCs declined 37% as a consequence of sluggish demand and extra stringent lending norms coupled with their liquidity disaster. As per the information offered by FIDC, the entire variety of loans disbursed within the final fiscal 12 months to the auto sector was round INR 94,462.24 crore, in opposition to INR 149,867.22 crore in FY 2019-2020.

Sum of Sanctioned Quantity (Cr)

| Lender Kind | FY 2019-2020 | FY 2020-2021 | %Change |

| Auto Mortgage | 2,774.25 | 1,225.74 | -58.81 |

| Auto Mortgage (Private) | 58,827 | 35,583 | -40 |

| Business Automobile Mortgage | 78,378 | 21,826.64 | -72.15 |

| Development Gear Mortgage | 9,887.98 | 35,826.86 | 262 |

| Whole | 149,867.22 | 94,462.24 | -37 |

CV financiers are the worst hit

Out of all of the segments, financiers to the business car sector proceed to stay cautious as the general truck utilisation stage on the nationwide stage touched historic lows with no indicators of a serious rebound in demand within the close to future. “Combining the three elements – restructured loans, improve in delinquencies and hike in write-offs, incremental stress of 300-350 bps has created CV loans up to now one 12 months. This has prompted NBFCs to tighten credit score dangers,” AM Karthik, vice chairman and sector head, monetary sector rankings, ICRA Chennai, stated.

Earlier than hitting the underside throughout April-Might, the enterprise of Shriram Transport Finance, one of many main NBFCs that derives 75% of its income from the CV sector, had reached nearly pre-COVID stage January-March when the financial exercise began returning to normalcy.

In line with Umesh Revankar, CEO & MD, Shriram Transport Finance, truck operators continued to undergo as a consequence of numerous restrictions on their actions which closely impacted the brand new disbursement cycle.

“In the course of the first two months of the present fiscal, our disbursement to the sector has lowered to lower than half. This phase remains to be reeling below the influence of revised axle norms. The pandemic blows additional worsen the situation. Although we anticipate to see some inexperienced shoots from this month onwards,” Revankar added.

Banks vs. shadow banks

Within the auto phase, the NBFCs have been constantly shedding their enterprise to the scheduled business banks. Of late the general public sector banks have been very aggressive with a serious contribution in inventories coming from them, stated an Emkay Analysis notice. “As a result of decrease rates of interest and longer mortgage tenures, clients favor banks to NBFCs,” the analysis notice identified.

In the course of the first two months of the present fiscal, our disbursement to the sector has lowered to lower than half. This phase remains to be reeling below the influence of revised axle norms. The pandemic blows additional worsen the situation.Umesh Revankar, CEO & MD, Shriram Transport Finance

Karthik of ICRA Chennai highlighted that banks are rising their publicity in high-ticket segments like passenger automobiles and business automobiles. “COVID is the first cause for the decline in disbursement. Most significantly, there may be elevated aggressive stress from banks as a result of they began wanting on the auto sector as a supply for diversification when their company loans stopped rising,” he added.

One other issue is throughout the first wave of COVID and its aftermath, many homeowners held onto their automobiles. In line with Vinkesh Gulati, president, FADA, the shoppers largely traded within the previous ones as their supply of earnings dried up. “Mortgage efficiency weakened as a result of continued excessive unemployment price that restricted the borrower’s earnings and their means to service debt,” he identified.

The outlook for FY22

The automobile makers’ bumpy roads could also be short-term. Pent-up demand, a robust employment image and the upcoming festive interval, historically an excellent season for car gross sales, might flip issues round to their favour.

In line with Fitch Scores, a much less extreme financial influence from the pandemic’s second wave and resilient purchaser sentiment will help a swift rebound in India’s automotive demand after curbs are eased.

“We consider much less stringent curbs and decrease enterprise disruption will restrict the financial fallout in contrast with final 12 months. The drop in auto gross sales quantity in Q1 FY22 from This fall FY21 might be slower than the decline of greater than 70% in Q1 FY21,” stated the ranking company.

Nevertheless, business observers are cautious. In contrast to the primary COVID wave which was cushioned with a number of measures resembling regulatory moratorium, further funding by means of the emergency credit score line assure scheme and a pointy pent-up demand restoration, specialists opine that the result could also be completely different throughout the second wave.

Underlining the influence, Gulati stated, “Because the an infection has penetrated in rural areas this time, collections will develop into tougher. Furthermore, lowered debtors’ financial savings and rising working prices as a consequence of gas inflation will even solid a spell on debtors’ money flows.”

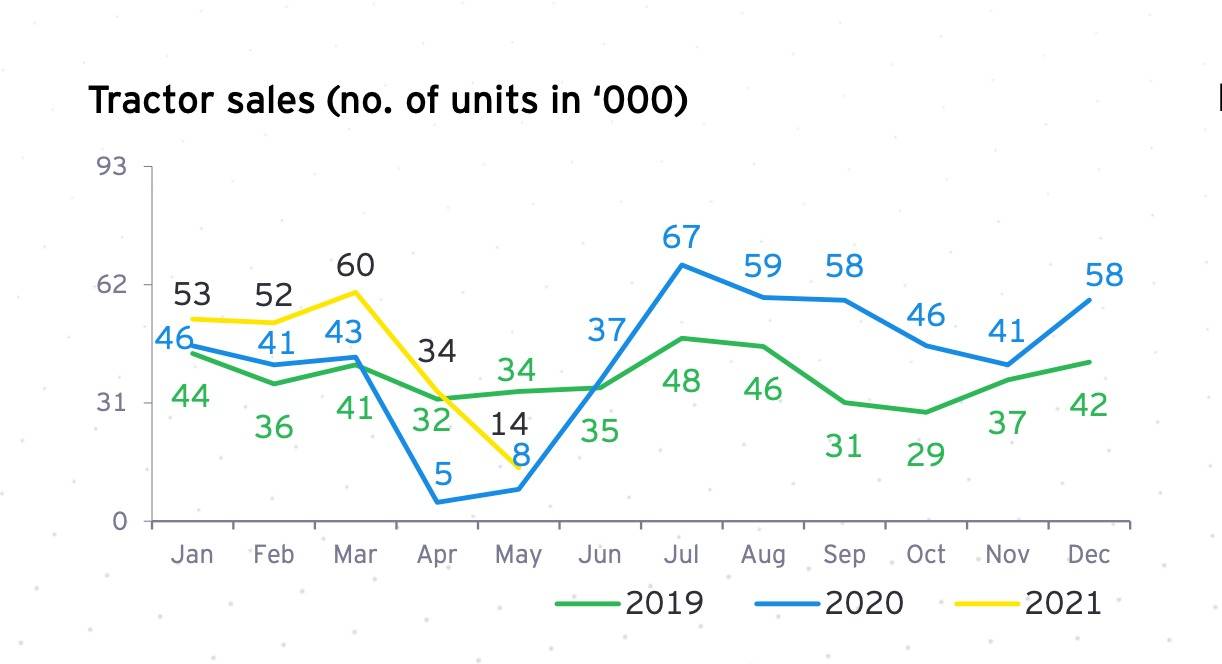

All-time low gross sales of heavy vans pressured among the shadow banks to search for different lending locations for survival. “As a result of erosion of demand few NBFCs within the business car area diverted to tractor financing the place gross sales continued their wholesome run even throughout the lockdown. This helped in bringing the credit score progress of financing firms, ” stated one business knowledgeable.

No matter diversification, there might be a marginal influence on the profitability of those firms because the unfold of the virus is extra acute in rural areas on this wave, the particular person talked about above stated. And subsequently, he added, rural demand and sectors depending on the agricultural financial system together with tractors have come below stress.

As per business knowledge, tractor gross sales in Might crashed to about 14,000 items on a sequential foundation from about 34,000 items in April.

On the outlook, India Scores and Analysis see a major influence on the asset high quality of CV financiers as a consequence of their debtors’ lowered capability utilisation, increased working prices, and moderating money flows.

“The rising traits of rising mortgage tenures throughout car financiers to cut back the servicing burden for debtors, nevertheless, might result in an increase in losses given the defaults for collaterals,” the company added.