AEye Inc and a blank-check agency backed by monetary companies firm Cantor Fitzgerald on Monday amended their merger settlement, valuing the lidar sensor maker at $1.52 billion, citing valuation modifications of publicly traded lidar firms.

In February, AEye had agreed to go public by means of a merger with particular goal acquisition firm (SPAC) CF Finance Acquisition Corp III, in a deal that valued the corporate at $2 billion.

The businesses attributed the phrases of the amended deal to “altering circumstances” within the automotive lidar trade.

Lidar friends Ouster Inc and Peter Thiel-backed Luminar Applied sciences Inc, which additionally took the SPAC path to get publicly listed, have misplaced 10% and 22% of their worth, respectively, since making their market debuts.

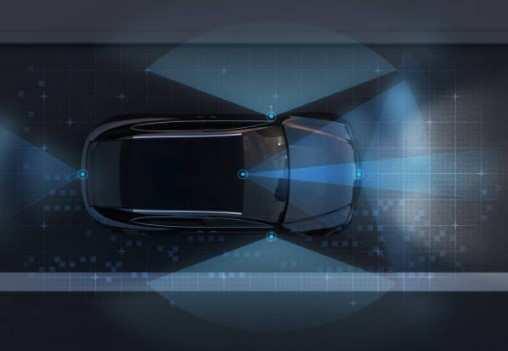

Based in 2013 by former Lockheed Martin and NASA engineer Luis Dussan, AEye is one among a number of corporations specializing in a comparatively younger expertise that makes use of light-based sensors to generate a three-dimensional view of the highway.

Clean-check corporations, or SPACs, like CF III are shell firms that elevate funds by means of an preliminary public providing to take a personal firm public.

Lidar sensors, which use laser gentle pulses to render exact pictures of the atmosphere across the automotive, are seen as important by many automakers to permit increased ranges of driver help, proper as much as making them able to self-driving.