Personalisation and transparency are features making waves for buyer expertise within the trade

The connection between prospects and auto insurers has advanced extra within the final 10 years than within the final eight many years. Because the world’s connectivity progresses extra day by day, the insurance coverage trade has skilled a shift as nicely. On-line quotes, the recognition of self-service, simpler entry to info, and firm critiques have put energy within the fingers of the shopper, now greater than ever. The choice-making course of is helmed by them, not the insurers.

Within the UAE, auto insurance coverage charges decreased within the final 12 months, offering reduction to automotive homeowners. Charges in direction of the tip of 2020 had a 3 to 5 % distinction to what they’d been firstly for widespread household fashions. On greater four-wheelers, there was a ten to 12 % distinction in the identical interval. Social restrictions because of the pandemic have resulted in fewer individuals on the roads, which has resulted in fewer accidents. Since then, auto insurance coverage is witnessing an upward development and continues to point out competitiveness between native suppliers. With digitalization on the forefront of the nation, aligned with UAE Imaginative and prescient 2021, the insurance coverage trade is becoming a member of many others which have quickly digitized during the last 12 months.

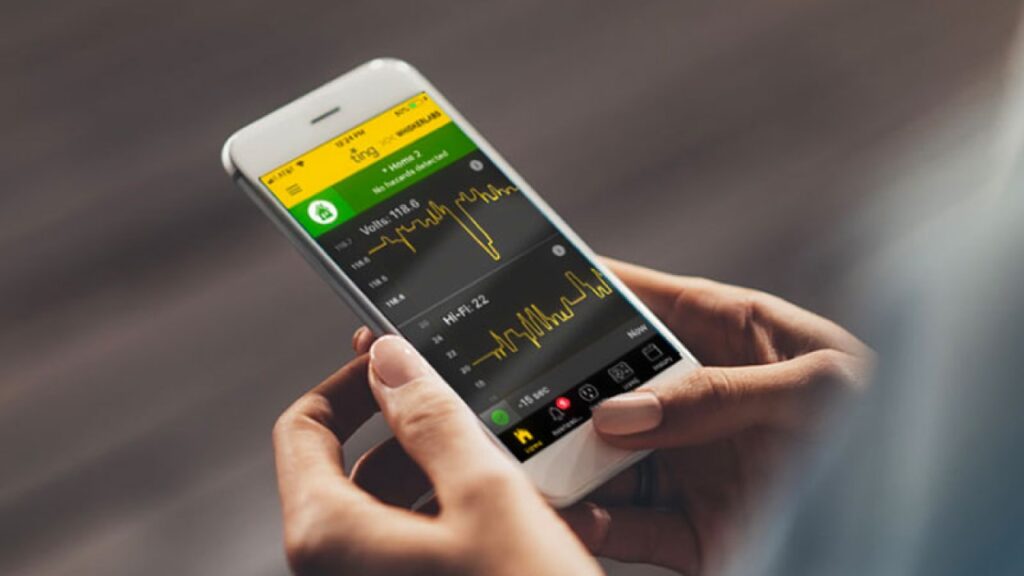

In keeping with J.D. Energy 2020 U.S. Auto Insurance coverage Examine, insurance coverage firm web sites surpassed brokers by way of the significance of shopper interplay and repair by offering increased buyer satisfaction for the primary time within the examine’s 21-year historical past. A digital platform outperforming face-to-face company interplay in customer support is a huge leap ahead for the trade. An progressive instance of an auto insurance coverage supplier who’s placing the shopper first utilizing digital channels is Beema, one of many fastest-growing InsurTech gamers within the area. It offers insurance coverage tailor-made to particular person prospects’ wants by way of quite a lot of cowl choices. It has additionally developed a user-friendly cellular app and web site. Prospects can entry coverage info, get quotations and lift points and obtain a response normally inside 5 minutes. This isn’t doable in a conventional insurance coverage agent format, the place normally the turnaround for all these features is, on the very least, just a few days.

The facility of knowledge

To resolve the dilemma ‘What do prospects need?’ gathering and analyzing buyer information is important. With it, insurance coverage firms can transfer away from the normal pricing constructions for premiums and emphasize customization. It permits a 360-degree view of consumers, so the agency is healthier outfitted to supply them the precise merchandise on the proper time.

With information, Beema can perceive its prospects’ wants and ship distinctive and thrilling advantages to its prospects. For instance, it gives Pay-per-kilometer choices the place prospects can earn as much as 25 % cashback on their coverage premiums relying on their yearly mileage. All they should do is ship their mileage studying to Beema and if it is lower than 20,000 km, they will obtain the corresponding money again on the finish of the 12 months. This 12 months, Beema’s cashback common is Dh305 thus far.

Backside line: Disrupt or be disrupted

With these developments, buyer expertise has change into the driving drive behind insurance coverage premiums and merchandise. Suppliers face imminent disruption by new and profitable gamers which have entered the UAE market in 2020, which supplies prospects new decisions, forcing conventional insurers to rethink their everlasting decisions from inside and outdoors the trade.

One of many apparent adjustments is that prospects have change into accustomed to buying all kinds of services over the online, and insurance coverage is not any exception.

One other is rising calls for for personalised services in a progressively linked world and expertise that may undo conventional enterprise fashions.

In keeping with Deloitte’s ‘Insurer on the brink’ report, buyer loyalty is not an element. Insurance coverage as an trade doesn’t rank excessive in buyer expertise, leaving a niche for brand new customer-driven suppliers, who’re filling it. With a brand new tech-savvy technology on the verge of turning into insurance coverage purchasers, it solely is sensible that digital choices and cellular apps are paramount. Ease of use, low value, and good buyer expertise are key to gaining and retaining prospects. Within the age of data, potential patrons are extra knowledgeable and complicated. As costs have change into extra clear, prospects are open to new propositions based mostly on safety, mobility, and completely different sorts of protection – and these propositions require new, dynamic pricing constructions. Beema is altering the sport on this facet, offering transparency on various cowl choices, providing reductions on gasoline, automotive washes, oil adjustments, and upkeep, together with 24-hour roadside help, assured repairs, and round the clock service.

Within the UAE, Beema is a trusted, verified, and impartial insurance coverage firm that’s within the current. It’s a pioneer on the subject of the Pay-per-kilometer coverage and is the area’s first digital automotive insurance coverage providing. With respect for buyer’s time and the period of immediate gratification, Beema offers a quote inside three minutes and solely takes 5 to finalize a purchase order. Consistently innovating, the corporate served over 20,000 prospects in its first 12 months alone, gaining one % of the market share.

Deepu Kesava Panicker, a Beema buyer, credit the corporate’s choices and repair. “Dwelling in a world of providers, it is extremely necessary to grasp how qualitative the service we obtain is. The benchmark for me is expertise and mine with Beema has been very constructive. It commits to end-to-end service and responds to requests on time,” she says.

Some persons are cautious and keep away from extra driving after they can, therefore creating lesser threat. Such prospects profit probably the most from a cashback proposition equivalent to Beema’s Pay-per-kilometer. Krishnakumar Arangath, who owns a number of autos together with 5 vehicles, and two motorbikes, says, “With the variety of autos I personal, I cope with insurance coverage insurance policies extra usually than most individuals. I took on the duty of researching the perfect one for me. I chosen Beema firstly as a result of its pricing may be very aggressive. Secondly, it goes the additional mile in the case of customer support. The staff is extraordinarily responsive and I’ve by no means had a difficulty with them. Thirdly, there aren’t any different suppliers who supply so many further goodies like roadside help, referral bonus, and the distinctive cashback system in keeping with the kilometers you have pushed.”

With a number of industries being disrupted this 12 months, insurance coverage suppliers ought to take heed to their present and potential prospects first after which act. As Beema has executed, insurance coverage suppliers have to make important efforts to take the lead in placing their prospects on the core of their enterprise and create/adapt merchandise based mostly on prospects’ calls for. Adjusting to this swiftly creating ambiance on their very own is important as, in any other case, opponents will dictate how they modify.