Chennai: Regardless of the disruption attributable to Covid-19 to vehicle gross sales, the monetary yr 2020-21 has seen a pointy enhance in car loans excellent in financial institution books.

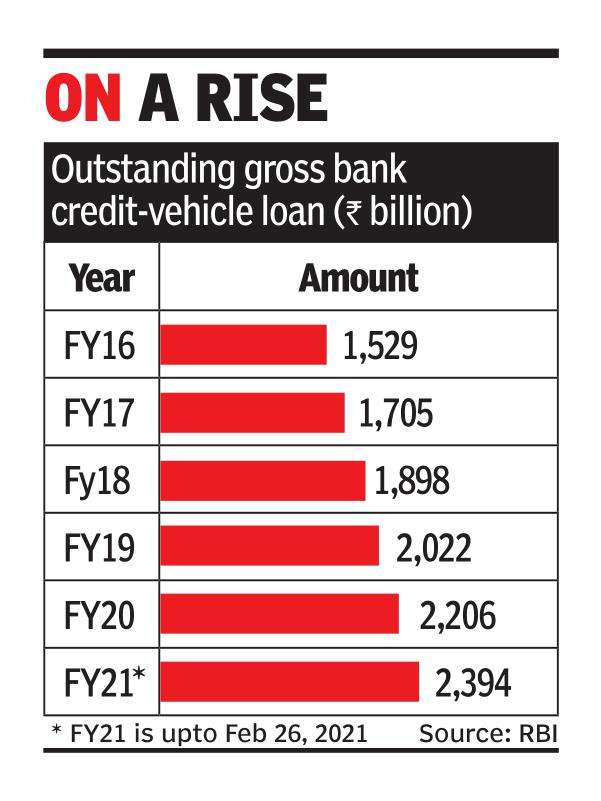

Chennai: Regardless of the disruption attributable to Covid-19 to vehicle gross sales, the monetary yr 2020-21 has seen a pointy enhance in car loans excellent in financial institution books.In line with the most recent Reserve Financial institution of India information, excellent car loans with banks hit a brand new excessive of Rs 2,39,400 crore in FY21 as much as Feb 26, which is a rise of 8.5% from Rs 2,20,600 crore on the finish of FY20.

Incremental development in auto loans at Rs 18,800 crore within the first eleven months of FY21 was increased than mortgage e book development in different monetary years aside from FY18 when auto loans grew by Rs 19,300 crore. It was Rs 17,600 crore in FY17, Rs 12,400 crore in FY19, and Rs 18,400 crore in FY20.

Auto financiers say there are a lot of causes behind this development. “It may very well be a mix of things together with the upper ticket measurement loans notably in passenger automobiles mixed with the mortgage moratorium and aggressive restructuring by banks,” mentioned Vyomesh Kapasi, managing director, Kotak Mahindra Prime. All of those would impression the excellent mortgage pool for car financing.

Clients opted for 90% financing notably in passenger automobiles and money purchases went down which was earlier round 10-15% of gross sales.Ramesh Iyer, managing director, M&M Monetary Providers

Round 80% of automobiles and SUVs in India are financed and almost 100% of business automobiles are purchased on loans. Two-wheelers have decrease penetration of fifty%-60%.

Financiers say the pockets pinch through the yr additionally prompted clients to go for longer tenures and smaller money down fee.

“In a yr which noticed wage cuts and financial issue, higher-priced fashions like SUVs did higher, reductions had been whittled down and so the mortgage ticket measurement went up. Clients opted for 90% financing notably in passenger automobiles and money purchases went down which was earlier round 10-15% of gross sales,” mentioned Ramesh Iyer, managing director, Mahindra & Mahindra Monetary Providers. Car financing penetration additionally went up general as tractor financing took off.

The rise in mortgage disbursement mirrored within the e book measurement as properly.

In line with Indian Financial institution, for instance, mortgage disbursement went as much as Rs 1,130.52 crore in FY21 from Rs 974 crore in FY20.

“Disbursal in mid-segment vary (Rs 5-Rs 10 lakh) was extra which drove the car mortgage disbursal for the yr FY21,” mentioned a financial institution spokesperson. The typical car mortgage ticket measurement went as much as Rs 5.43 lakh in FY21 from Rs 5.31 lakh in FY20.