In March 2020, insurance coverage regulator Insurance coverage Regulatory & Growth Authority of India (IRDAI) had introduced that insurers must supply a reduction of 15% on motor third social gathering premium for electrical automobiles to incentivise their use.

Whereas the low cost introduced by the regulator is an efficient incentive to begin with, Adarsh Agarwal, appointed actuary at Digit Normal Insurance coverage, stated EV insurance coverage gives an enormous alternative for insurers attributable to decrease danger.

“EVs have lesser publicity on highways and so have a greater danger,” he defined. Nonetheless, he identified that by way of challenges, the theft of batteries in sure places can improve the loss ratio on insurers.

Even Animesh Das, head (product technique), Acko Insurance coverage, identified that the variety of EVs on the roads are very much less as it’s primarily early adopters who’re choosing them. Which means that the danger of an EV being concerned in accidents shall be a lot decrease than an equal conventional automobile, providing a very good alternative for insurers to make some revenue throughout the auto insurance coverage sector.

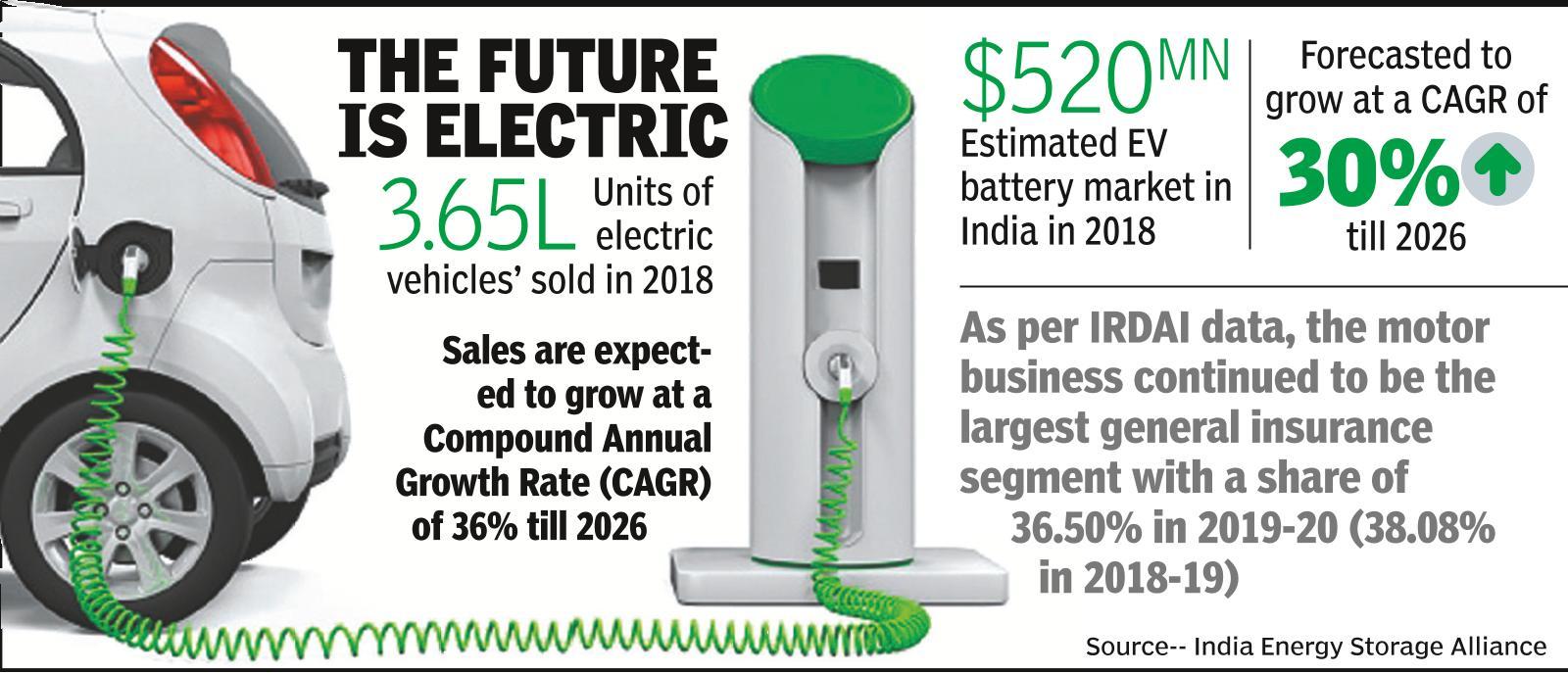

As per IRDAI knowledge, the motor enterprise continued to be the most important basic insurance coverage phase with a share of 36.50% in 2019-20 (38.08% in 2018-19) adopted by well being phase with 30.10% market share (30% in 2018-19).

At present, the EV insurance coverage product is just like the normal motorized vehicle insurance coverage product, however with an increase in EV gross sales the regulator is predicted to permit additional differentiation within the product assemble, stated Amitabh Jain, head (well being & motor underwriting & claims), ICICI Lombard.

“A number of the differentiating elements in an EV are the presence of battery (which entails main a part of the EV’s price) and the charger…We’re evaluating the state of affairs and will method the regulator for approval to supply add-on covers for battery and charger,” Jain added.

Subrata Mondal, government VP, IFFCO Tokio Normal Insurance coverage Firm, additionally added that because of the lack of information on EVs, the insurance coverage pricing would possibly observe the normal methodology within the preliminary levels. Nonetheless, because the utilization will increase and subsequent time passes, insurers can arrive on the proper premium for EVs.

“Although initially the price of a number of movable EV components shall be greater, they are going to come down as the amount will increase. Consequently, the servicing time at garages or workshops shall be decrease, making certain a faster turnaround. These elements will even favourably affect the premium,” he added.