AEye Inc stated on Wednesday it had agreed to go public by way of a merger with a blank-check agency backed by monetary providers firm Cantor Fitzgerald, in a deal which values the lidar sensor maker at $2 billion.

The take care of CF Finance Acquisition Corp III is predicted to supply AEye with gross proceeds of $455 million, raised by the SPAC throughout its IPO and from personal traders together with GM Ventures, Subaru-SBI and Intel Capital, amongst others.

Different AEye traders embody LG Electronics Inc, Airbus Ventures and auto provider Continental AG, which acquired a minority stake within the California startup in October.

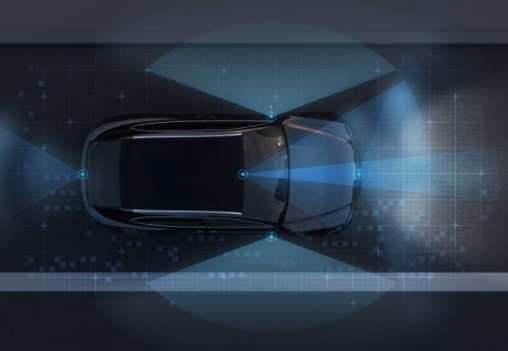

Based in 2013 by former Lockheed Martin and NASA engineer Luis Dussan, AEye is considered one of a number of corporations specializing in a comparatively younger expertise that makes use of light-based sensors to generate a three-dimensional view of the street.

Clean-check corporations, or SPACs, like CF III are shell corporations that elevate funds by way of an preliminary public providing to take a non-public firm public.

AEye is the most recent lidar sensor maker to take the SPAC merger path to enter public markets, following within the footsteps of friends Ouster Inc and Peter Thiel-backed Luminar Applied sciences Inc.

The mixed firm, to be referred to as AEye Holdings Inc, will probably be listed on the Nasdaq after the merger.

Guggenheim Securities and Cantor Fitzgerald & Co are serving because the monetary and capital markets advisor to AEye and CF III respectively.