Amit Chadha, the deputy CEO and board member at L&T Expertise Providers (LTTS), along with colleague Subrat Tripathy, gained an over $100 million deal from ExxonMobil final yr. The contract entails supporting two ExxonMobil built-in refining and chemical compounds manufacturing amenities within the US, together with web site sustenance, engineering and management automation. LTTS didn’t disclose the title of the client, however TOI was advised that LTTS displaced a US vendor.

“We will likely be offering an onsite-offshore mannequin for engineering web site help and increasing their digital footprint. We had labored with the client earlier than at their websites in Canada and Singapore. That’s the place we obtained our canine tags and we took it from there,” Chadha stated. Chadha stated they’ve walked away from offers the place they assume they’ll’t meet margin goals.

LTTS has embraced a glocal mannequin –it opened its sixth engineering centre in Rockford to cater to aerospace and defence prospects. It has a facility in Israel that homes the next-generation cyber-security centre of excellence and a ASIC {hardware} design centre. Its Gothenburg digital engineering centre is a nearshore growth hub for LTTS’ prospects in Europe.

LTTS works with 53 of the world’s high ER&D firms, throughout industrial merchandise, medical units, transportation, telecom & hi-tech, and course of industries.

In engineering providers, there’s rising curiosity in build-operate-transfer (BOTs) fashions. Distributors are additionally gravitating in direction of high-margin ER&D contracts in automotive, aerospace and semiconductors. “The principle drivers of enormous engineering offers over the previous yr have been price takeout, M&A restructuring, partnerships, captive divestment and product carveout,” stated Pareekh Jain, founding father of engineering providers advisory Pareekh Consulting.

World ER&D spend continues to be on the upward trajectory and is ready to the touch the $ 2.1 trillion by 2022, up from $ 1.7 trillion in 2017. The spends, pushed considerably by the highest 2000 corporates, is anticipated to the touch $ 900-$1000 billion over the identical interval with automotive and semiconductors accounting for 44% of whole company ER&D spend, confirmed knowledge from a Nasscom report.

Engineering R&D is the quickest rising vertical within the Indian IT providers area. Nasscom estimates that India’s ER&D market will develop to $42 billion by the 2022 fiscal, from $24 billion in FY2017. The expansion drivers embrace business 4.0, EVs, autonomous/ linked automobiles, sensible merchandise/ providers, and automation.

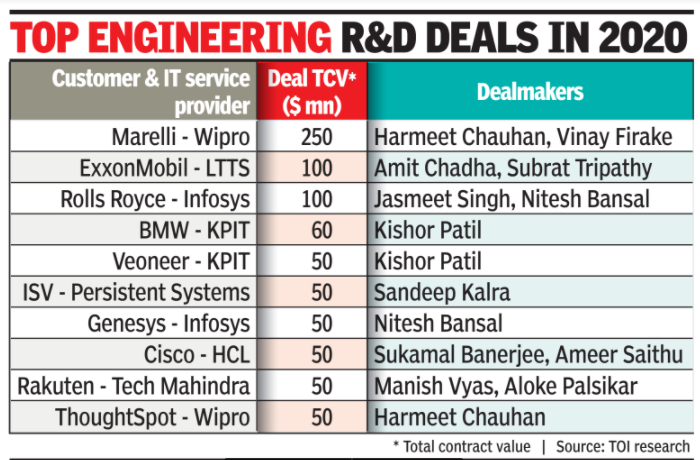

Final yr, KPIT cofounder Kishor Patil led two vital offers within the auto engineering area – Veoneer and BMW, with whole contract values (TCVs) of $60 million and $50 million respectively. Sweden-based Veoneer focuses on superior driving help methods (ADAS). Veoneer will leverage software program know-how from KPIT for numerous car programmes globally for autonomous driving, ADAS and AUTOSAR (a worldwide partnership that develops standardised software program framework for clever mobility).

Harmeet Chauhan, SVP of commercial & engineering providers at Wipro, and Vinay Firake, SVP and MD for Wipro Nordics, have been the rainmakers for one of many firm’s largest offers in automotive software program engineering providers – from Italy’s Marelli. Sources advised TOI that the deal is round $250-$300 million (Rs 1,850-2,220 crore). That is the second deal win for Wipro from Marelli.

Persistent Techniques CEO Sandeep Kalra gained an over $50 million deal in ER&D from an impartial software program vendor (ISV). Kalra stated they’re serving to enterprises construct and launch newer digital merchandise. “One in all our bigger offers is with one of many largest tech corporations on the affected person engagement platform and while you get that sort of work, they don’t underneath ball on the greenback to absolutely the final cent. They’re you to deliver the perfect of the expertise,” he stated.