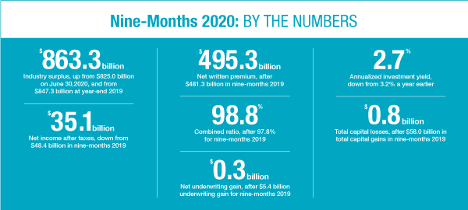

Within the first 9 months of 2020, web revenue for the U.S. property/casualty insurance coverage business dropped 27.5% to $35.1 billion and web underwriting positive aspects declined to $0.3 billion, from $5.4 billion a 12 months earlier because the business handled the consequences of the COVID-19 pandemic and an historic disaster season.

Based on a report from information agency Verisk and the American Property Casualty Insurance coverage Affiliation (APCIA), the deterioration in underwriting outcomes was due, partially, to the losses and loss adjustment bills from catastrophes, which greater than doubled to $47.1 billion for nine-months 2020 from $21.5 billion in the identical nine-month interval a 12 months earlier.

Verisk’s PCS reported that 2020 set a report for the variety of U.S. catastrophic occasions. The 2020 catastrophes included 19 occasions with at the very least $1 billion in direct insured losses in america (17 within the first 9 months), together with the primary riot and civil dysfunction occasion to exceed that threshold.

The U.S. additionally recorded one of many largest deteriorations on the Verisk Maplecroft Civil Unrest Index over the previous 12 months—growing from the 91st riskiest jurisdiction by the second quarter of 2020 to the thirty fourth. The index assesses the chance of disruption to enterprise attributable to civil unrest and features a spectrum of incidents, from protests to violent mass demonstrations and rioting.

Auto Insurers

Auto insurers benefited from the diminished driving exercise because of the pandemic through the first 9 months of 2020, with the pure loss ratio for auto insurance coverage enhancing to 56.6% from 65% in comparison with the identical interval within the earlier 12 months. Many automobile insurers supplied partial premium refunds to present policyholders and adjusted their charges. Verisk’s ISO estimates that insurers supplied roughly $11 billion in direct premium refunds and renewal credit to policyholders.

Based on Verisk, the impact of potential charge adjustments pushed partially by COVID-19 can’t be reliably estimated.

Policyholders’ surplus rose $16 billion to $863.3 billion as of Sept. 30, 2020, from $847.3 billion as of Dec. 31, 2019, pushed by development within the inventory market.

The report stated that whereas it would take time earlier than the insured losses straight attributable to pandemic might be reliably estimated, the influence on premiums was quick. Because of the financial disruption, customers and companies deferred and canceled massive purchases and capital investments, which led to diminished premium exercise. The written direct premium development slowed to 2.3% for the primary 9 months of 2020 in comparison with 4.8% in the identical time interval in 2019.

Robert Gordon, APCIA senior vice chairman, coverage, analysis and worldwide, stated analysts anticipate business traces insurers to face important reductions in premiums because of audits that replicate diminished revenues and payrolls.

“The business continues to face the robust headwinds of unknown however probably extreme future COVID-19 associated losses and long-term claims,” Gordon stated.

The COVID-19 vaccines ought to assist the financial restoration going ahead however many questions stay.

“The start of COVID-19 vaccination efforts has supplied some hope for folks in america and throughout the globe,” stated Neil Spector, president of ISO at Verisk. “However the U.S. financial system and the insurance coverage business nonetheless face many challenges which can rely on our progress in ending the pandemic.”

“How lengthy will it take to vaccinate nearly all of the inhabitants? What influence will new strains of the illness have on its unfold? How will companies that require massive in-person crowds proceed to outlive? Which of the pandemic-driven adjustments are right here to remain? All of those questions may have a significant influence on the varieties of insurance coverage and repair that prospects anticipate,” Spector added.

Third-Quarter Outcomes

After taxes, insurers’ web revenue fell to $10.9 billion in third-quarter 2020 from $15.4 billion in third-quarter 2019, and their mixed ratio deteriorated to 101.3% in third-quarter 2020 from 98.8% in the identical interval a 12 months earlier.

Internet written premiums rose $5.0 billion, or 3.0%, to $171.3 billion in third-quarter 2020 from $166.2 billion in third-quarter 2019. Internet earned premiums grew 2.3% to $162.9 billion in third-quarter 2020 from $159.2 billion from the third quarter a 12 months earlier.

Outcomes from insurers reporting up to now on their fourth quarter performances — together with Vacationers, Chubb, Allstate, The Hartford and W.R. Berkley— counsel the P/C business could end the 12 months robust.

Associated:

Fascinated about Carriers?

Get automated alerts for this subject.