Traders have poured in about $9.3 billion into Indian startups to date in 2020 regardless of the Covid-19 pandemic upending many sectors of the economic system, information from trade tracker Tracxn confirmed.

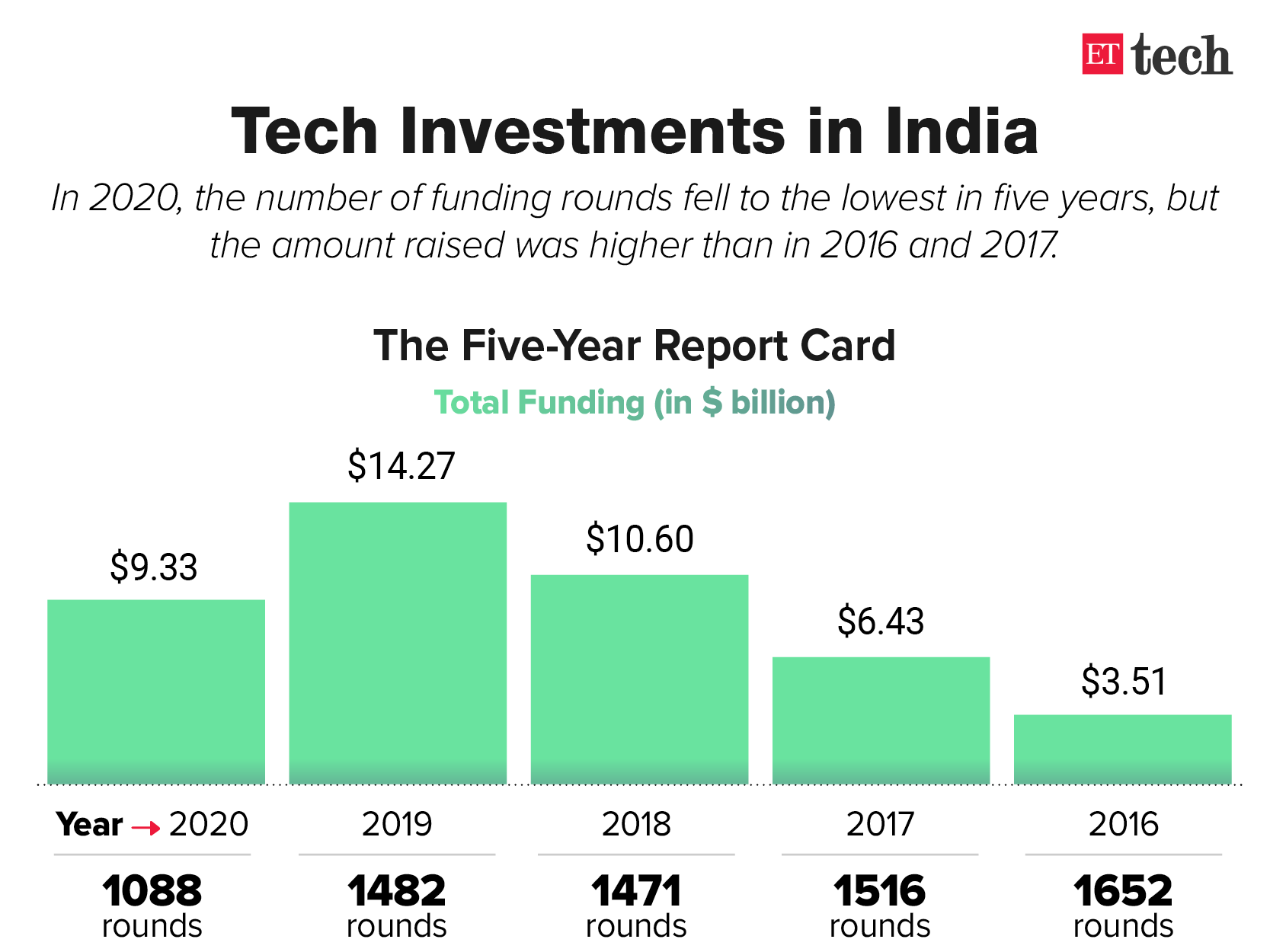

Traders have poured in about $9.3 billion into Indian startups to date in 2020 regardless of the Covid-19 pandemic upending many sectors of the economic system, information from trade tracker Tracxn confirmed.In December alone, greater than $1.5 billion was invested throughout firms together with meals supply app Zomato, logistics participant Delhivery, and InMobi’s Look, even at a time when deal closures often gradual as issues wind down for the yr. The investments have been unfold throughout 1,088 financing rounds, in accordance with the Tracxn information shared with ET.

In 2019, home startups had raised a complete of $14.2 billion throughout 1,482 rounds from January 1 to December 23.

Though the variety of funding rounds fell to its lowest in 5 years in 2020, the quantity raised was greater than 2016 and 2017 — when traders chipped in $3.51 billion and $6.43 billion, respectively — signalling continued investor curiosity this yr from each world in addition to home traders.

A number of the largest enterprise capital corporations doubled down on seed and Sequence A offers. There have been fewer $100-million funding rounds this yr (24 rounds totalling $4.71 billion), however these accounted for the majority of deal worth, Tracxn information confirmed. There have been 28 rounds of over $100 million amounting to $7.86 billion in 2019, in accordance with Tracxn.

The yr additionally noticed heightened mergers and acquisitions, with a number of corporates and strategic traders scooping up high-growth targets.

Main the pack was the acquisition of WhiteHat Jr ($300 million) by Byju’s, and Reliance Industries’ acquisition of on-line furnishings retailer City Ladder ($24 million) and on-line pharmacy Netmeds ($83 million), clocking greater than 20% progress in M&A transactions over the earlier yr.

Shopper healthcare, SMB SaaS (Software program-as-a-Service), fintech, e-grocery, ed-tech and med-tech have been clear winners this yr, as firms realigned enterprise fashions, pivoted and even shut down after the outbreak.

Large spike in seed & sequence A offers

“In comparison with final yr, 2020 has been a yr of upper deal velocity. Total, we dedicated to deploy 50% extra capital this yr than we did within the earlier yr,” mentioned Hemant Mohapatra, associate at early-stage enterprise capital agency Lightspeed India, which has backed firms equivalent to Oyo and Byju’s.

Over 80% of those offers have been in seed and sequence A phases, Mohapatra mentioned. “A number of of our portfolio firms accelerated their paths to sequence B+ rounds with curiosity coming in from world tier I funds earlier than they even went out to lift formally. We noticed extra momentum, and better test sizes at early phases throughout most sectors,” he added.

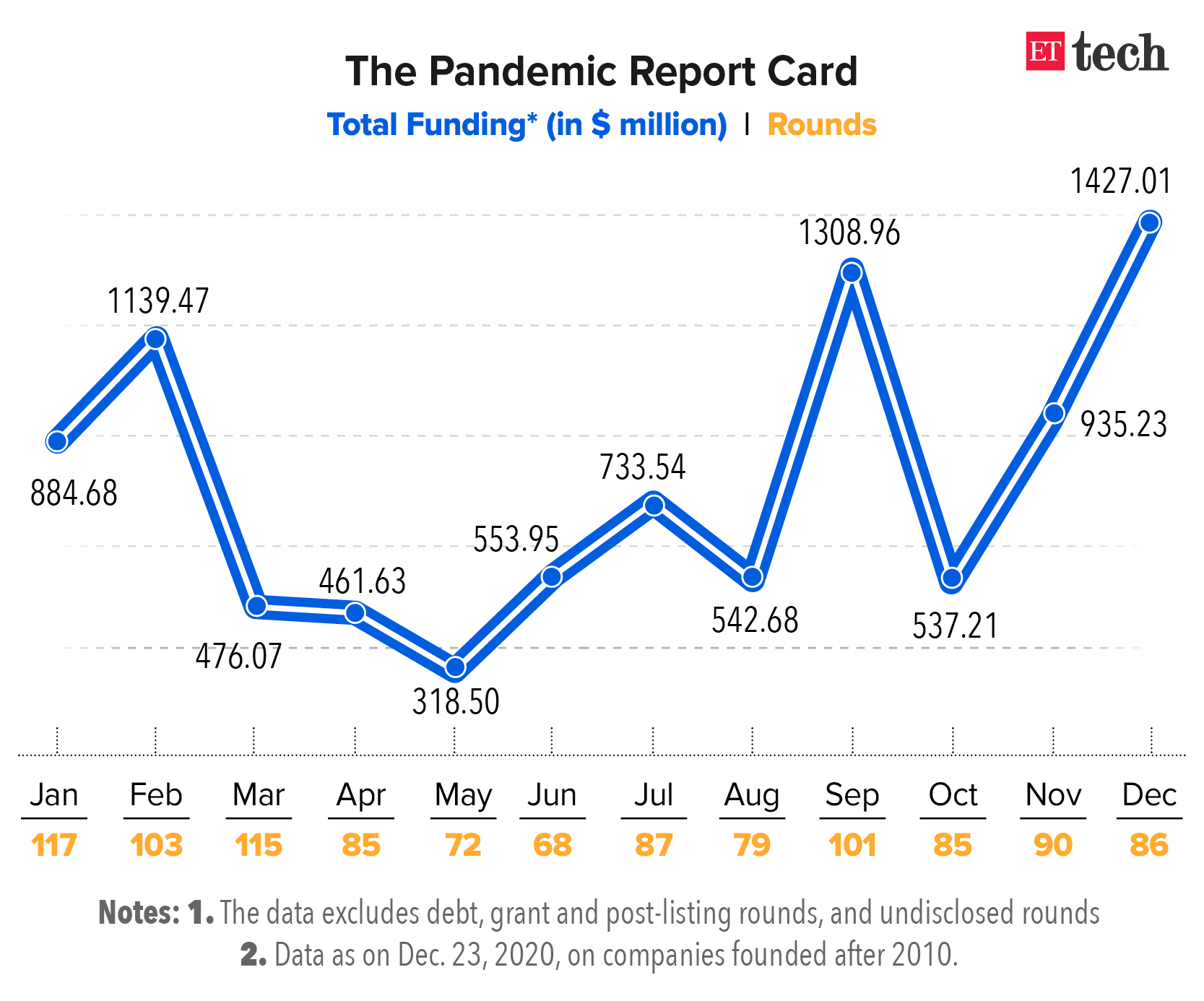

The lockdowns imposed in the course of the early a part of the yr impacted enterprise exercise throughout sectors. Deal exercise was gradual in April ($461 million raised by means of 85 rounds), Could ($318.5 million by means of 72 rounds) and June ($553 million by means of 68 rounds).

Nevertheless, traders have been again to the desk within the second half of the yr because the lockdowns eased throughout states by the top of June.

“For VCs, it has been a yr of two halves. The primary half was spent in supporting portfolio firms as a lot as doable. The second half noticed companies adapt to the brand new regular – and that’s why there was a rise in investing exercise in the direction of the top of the yr,” mentioned Prasun Agarwal, associate at Mumbai-based A91 Companions.

Large funding offers have been seen for startups equivalent to Byju’s, Unacademy, Zomato, Cred, Delhivery, Razorpay, Vedantu and Cars24.

Frothy valuations

The ed-tech and SaaS sectors noticed firm valuations ballooning, elevating considerations about frothiness, each in public in addition to non-public markets.

In distinction, offers in sectors equivalent to offline retail, restaurant SaaS, shopper lending, shopper mobility and development/real-estate declined sharply.

Offline providers marketplaces like marriage ceremony providers, agent-led feet-on-street commerce, industrial robotics, journey and hospitality additionally took a extreme beating.

The pandemic additionally compelled traders to pump in funds into present portfolio firms to assist them keep afloat.

“We needed to assist a few of our portfolio corporations (low single-digits) the place the funding rounds fell by means of, with top-ups,” mentioned Sajith Pai, director, Blume Ventures, which invests in early-stage startups.

“Lots of our portfolio firms are having the most effective months of their life and are both closing or have closed new rounds,” Pai added.

Falcon Edge, Tiger International, Sequoia Capital, Lightspeed Enterprise Companions, Accel and Steadview Capital have been a number of the most energetic enterprise capital traders this yr, the Tracxn information confirmed, as these funds invested throughout funding phases.

“VC traders proceed to be constructive for India over the long run. When the funding horizons are for 5-10 years, there are all the time blips alongside the journey. Investing exercise in 2020 reveals that Covid-19 has not modified the long-term view on the nation. In reality, expertise adoption in each, enterprises and customers have leapfrogged years, which has opened up great alternatives for younger companies,” Agarwal of A91 mentioned.