When you traded a inventory prior to now week, there is a honest probability it was Tesla.

Shares within the electrical automotive maker led by CEO Elon Musk rose nearly 3% on Wednesday and have now surged 40% since Nov. 16, when it was introduced Tesla would be part of the S&P 500 in December. Buyers rushed to purchase shares forward of index funds that shall be compelled to accumulate over $50 billion of its shares.

One in every of Wall Avenue’s most beloved — and hated — shares, Tesla was already the U.S. inventory market’s most traded firms by common every day worth, however buying and selling has surged in current periods, together with Tesla’s inventory value.

“It has been loopy. Since Tesla’s (introduced) inclusion within the S&P, you’ve got had plenty of managers on the market that did not personal sufficient of it having to purchase extra,” stated Sahak Manuelian, managing director of buying and selling at Wedbush Securities, in Los Angeles.

Retail traders utilizing apps like Robinhood are additionally accountable for a lot of the current quantity spike, Manuelian added.

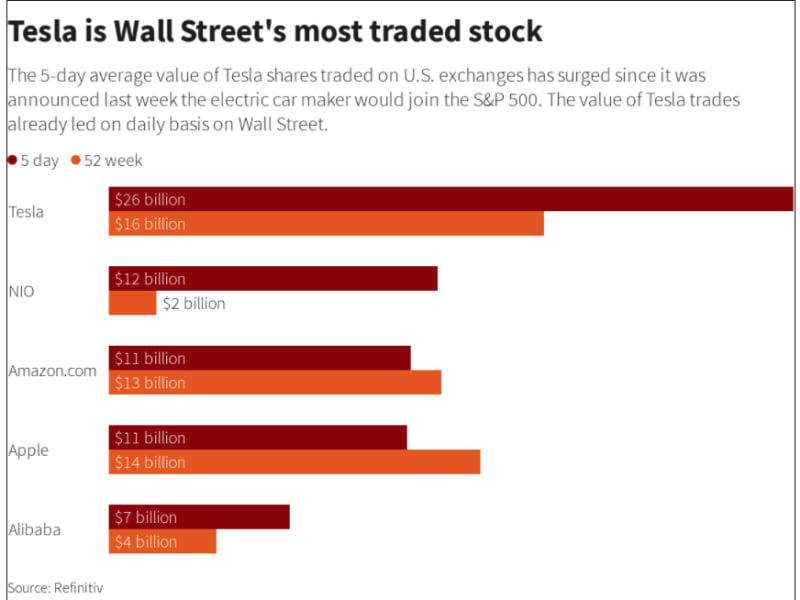

Merchants purchased and bought a mean of almost $26 billion of Tesla shares per session over the 5 days ending on Tuesday, accounting for nearly 8% of all inventory traded on U.S. exchanges, in response to Refinitiv information. That’s greater than the mixed worth of trades in Amazon.com Inc and Apple Inc over the identical interval.

At about midway via Wednesday’s session, merchants had exchanged $20 billion price of Tesla shares, in response to Refinitiv.

Up over 400% in 2020, Tesla has turn into by far the world’s most respected automaker, regardless of manufacturing that may be a fraction of Toyota Motor Corp, Volkswagen or Normal Motors Co.

Over the previous 12 months, Tesla has averaged over $16 billion a day in trades, adopted by Apple, at about $14 billion, in response to Refinitiv information.

Buying and selling in Chinese language electrical automobile maker NIO Inc has additionally surged in current weeks, with its shares almost doubling in November.

Together with NIO, buying and selling of shares within the nascent electrical automobile business reached a mean of $38 billion a day prior to now 5 periods, accounting for 12% of all buying and selling on U.S. exchanges. By comparability, merchants in the identical interval purchased and bought every day about $8 billion price of oil and gasoline shares together with Exxon Mobil and Chevron.