New Delhi: Home alternative tyre costs are all set to go up throughout classes throughout March-April as a result of increased costs for the commodities used for manufacturing tyres. This would be the third worth improve by the businesses after the lockdown.

Ceat, Apollo Tyres and Michelin have introduced their intentions about an impending 3%-8% worth hike. JK Tyre and others might accomplish that quickly.

The producers have attributed the newest worth will increase to rising commodity prices. However this pattern largely went unnoticed within the first two quarters when the uncooked materials prices, which comprise over two-thirds of the full value of manufacturing a tyre, had been hovering on the lowest ranges. Tyres manufactured in India have a ratio of 40% pure rubber and 50% of synthetics (petrol derivatives). The remaining 10% consists of miscellaneous inputs like metal.

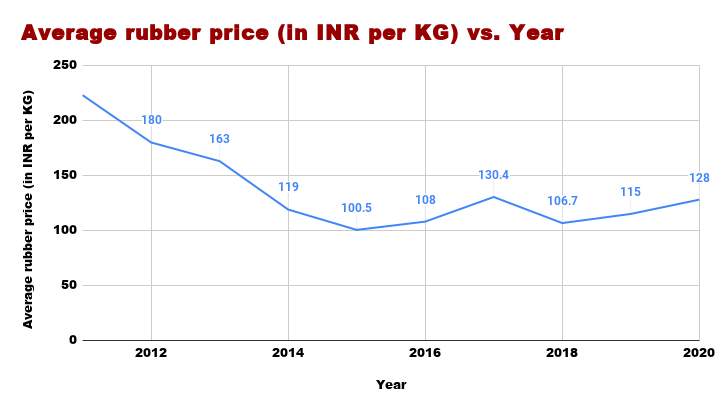

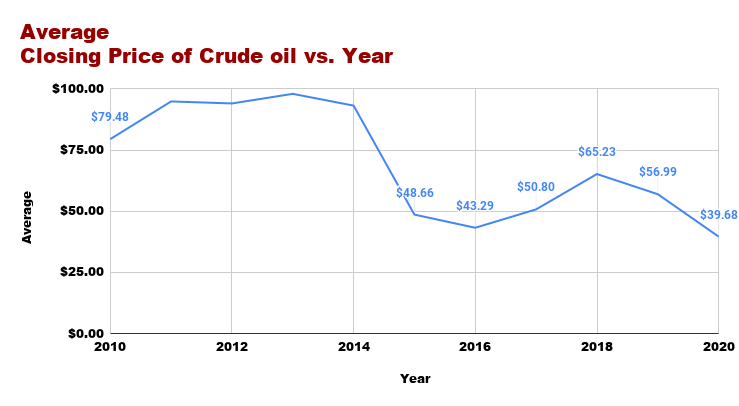

What’s necessary to notice is that, up to now with each rise in commodity costs tyre firms elevated costs. Information from the listed tyre firms that account for 75%-80% of the INR 60,000 crore vehicle tyre sector present 76.5% leap of their income up to now one decade. This was primarily owing to the sharp drop in uncooked materials costs. Crude oil and pure rubber costs have crashed virtually 50% and 32%, respectively within the final 10 years. Regardless of this, the producers have by no means made any vital discount in tyre costs in all these years.

Sellers’ dilemma

In accordance with ETAuto’s surveys of sellers from six cities, JK Tyre, MRF, Ceat, Goodyear and Apollo Tyres have, on a median, raised costs between 10% and 15% within the final six months from the earlier yr, relying on the tyre model.

Curiously, tyre majors jacked up costs by 5% to eight% within the first quarter of the present monetary yr when each the pure and the artificial rubber costs had been largely steady at decrease ranges. Then the tyre firms didn’t announce worth hikes on to the purchasers fairly they did it via the backdoor.

Marred by the Coronavirus pandemic and the restriction on Chinese language imports, tyre firms within the nation had been going through some critical manufacturing hurdles. Quickly after their resumption of operations after the lockdown, virtually each tyre firm slashed all of the schemes and reductions they used to supply to the retailers, the tyre sellers from Maharashtra, Haryana and Orissa stated.

In June 2020, the federal government imposed restrictions on tyre import from China to advertise home manufacturing. “Since July, we have now been getting restricted provides from the businesses. To satisfy necessities, small sellers began shopping for from the large ones at increased costs which in the end spiked the associated fee for the purchasers,” one of many tyre sellers stated on situation of anonymity.

For the big tyre retailers, the particular person cited above stated, the provision ready interval has elevated by a minimum of 10 days. “We at the moment are receiving deliveries in virtually 15-20 days after inserting the order in opposition to the 2-day supply time within the pre-COVID interval,” he added.

One other tyre vendor from the jap area stated that formally firms will not be giving any low cost, no matter low cost we’re offering is totally from our margin. And that is occurring when the business is witnessing decrease demand largely on account of prolonged alternative cycles.

Whereas the shortage of demand is eroding the margins of sellers, the businesses revenue from this together with increased realisation and benign enter prices, he stated.

“With the import restrictions, the market is going through critical scarcity of provides in sure tyre classes notably in SUVs and business autos. When any requirement for such tyres comes, we have now to promote from the previous inventory at virtually half the worth,” he stated.

Even costs of the most typical classes of tyres have been rising since June final yr as their home manufacturing value has been increased than their imported counterparts. As an example, the present market worth of 15-inch automobile radial tyre is INR 4,500 whereas the worth of an imported tyre was solely INR 3,500.

Moreover, fleet operators and transporters are additionally going through critical challenges in recouping their working bills as 30% of their working value is on tyres and the remaining on gasoline.

“Frequent worth hikes are hurting the trucking business probably the most because the cargo business is a worth delicate enterprise. Even the slightest spike in enter value shoots up transportation value,” S P Singh, convenor, All India Tyre Sellers Federation (AITDF), stated.

Home tyre business derives near 60% of its quantity from the alternative market and 28% from auto firms. The steadiness quantity comes from exports. The supply of a alternative tyre will depend on a number of components similar to quantity, manufacturing prices, sort of auto, and whether or not the tyre will likely be worthwhile. Due to this fact, in some instances, there might be just one tyre producer with a alternative tyre that’s appropriate for that automobile.

Furthermore, the higher number of sizes has pressured distributors and retailers to handle extra inventory which drives up their stock holding prices. These prices are handed on to the end-user.