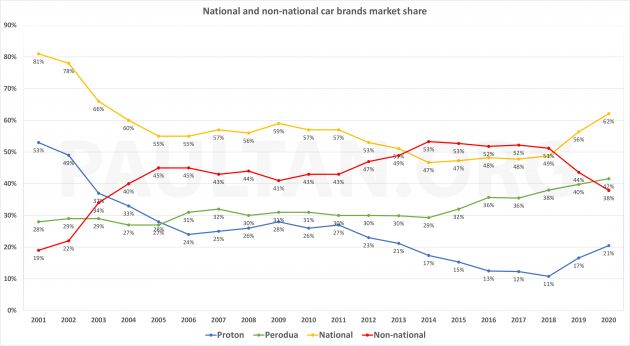

Nationwide manufacturers Perodua and Proton have seen their mixed market share rise in the previous couple of years, propped up by continued robust gross sales by market chief Perodua and the revival of Proton, which reached its nadir of 11% in 2018. Their mixed 62.1% share of 2020’s complete business quantity (TIV) is the best since 2003.

With six out of each 10 automobiles bought final yr being a Perodua or Proton, the slice of the pie for non-national marques is shrinking. From a excessive of 53% in 2014, the place international manufacturers overtook P1-P2 for the primary time ever, the development held agency until 2018 (51%). Nevertheless, the rise of Proton in 2019-2020 ate into the non-national share, and 2020’s 38% is the bottom degree for NNs since 2003 (34%).

We identified final week that this was not all the time the case. Actually, once we had been masking the 2014 TIV, the breaking information again then was the non-national manufacturers overtaking P1-P2 for the maiden time. Buoyed by an on-form Honda (2014 gross sales had been up 50% year-on-year), international manufacturers had been wanting up. P2 chiefs attributed the shift to market liberalisation and raised alarm again then.

Then, the nationwide manufacturers’ regular decline was completely all the way down to the poor efficiency of Proton, which noticed gross sales and share slide from 2011 till the Geely period (P2’s share hovered constantly above the 30% mark for a decade starting 2006, so it was pulling its weight). It was a time when the Japanese huge three manufacturers had been aggressive within the B-segment, introducing new fashions with entry costs that encroached into the highest finish of conventional Proton/Perodua territory.

The Protons of that interval – the Preve C-segment sedan, its Suprima S hatch sister, and the Myvi-fighting Iriz – didn’t put up a very good battle. Right here, we have a look again on the non-national fashions that capitalised on a weak Proton, and the rise – and subsequent fall – of Honda, Toyota and Nissan. To make it fascinating, we included Mazda, which methods and targets differ from its bigger counterparts.

The Energy of Desires

On this rise and fall story, the principle protagonist is Honda. One ought to by no means underestimate the ability of desires, however we’re betting that when Honda Malaysia was established in 2003, the bigwigs there by no means dreamt that it will in the future overtake Toyota in Malaysia, by no means thoughts passing Proton to be second within the gross sales charts.

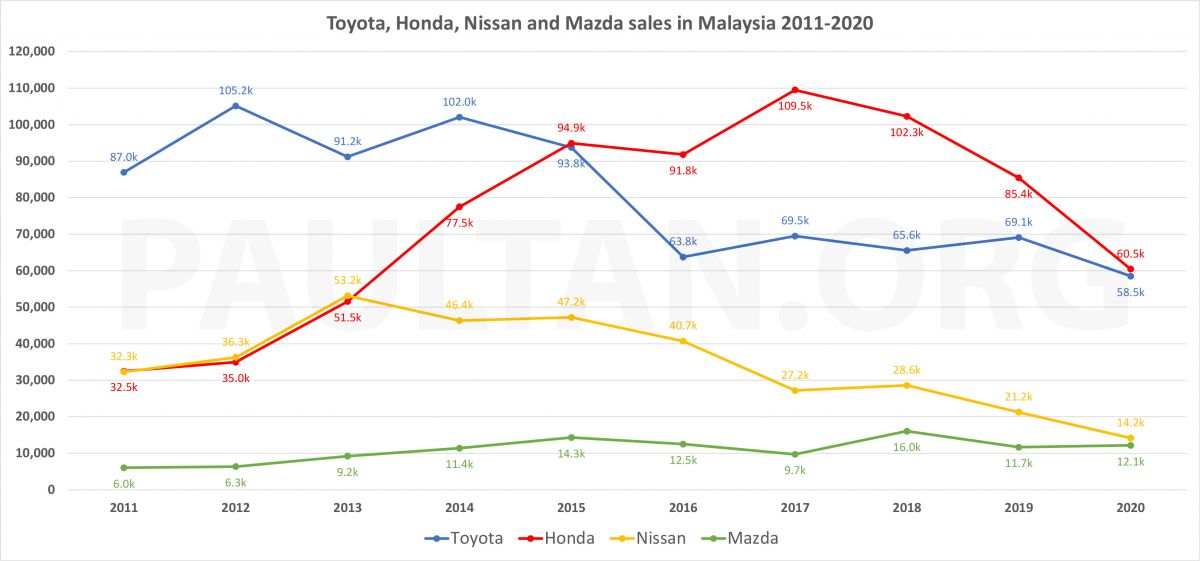

Honda did precisely that, pipping Toyota to the No.1 non-national spot in 2015, a place it has since held, though 2020 was a photograph end in its favour, identical to in 2015. Momentum was robust, and Honda went on to do what was beforehand unthinkable – in 2016, it deposed Proton to be No.2 total, a place it managed to occupy until 2018.

The climb was steep – simply see the purple mountain within the topmost chart. Again in 2012, Honda bought fewer automobiles than Nissan, and whereas each surged in 2013, Honda nonetheless ended the yr beneath Nissan (51,544 vs 53,156). It was heady days for Toyota then, flirting with the 100k mark and sometimes getting the products (105,151 in 2012 and 102,035 in 2014). However simply two years after it was sparring with Nissan, Honda overhauled the large T to be the highest international make in Malaysia.

How did that occur? Consider the fourth-generation Metropolis, which debut in March 2014, as VTEC kicking in. The sedan, which really moved the B-segment recreation on, was joined by its Jazz sister hatchback in July. These new entries boosted Honda gross sales by 50% in 2014. The next yr can be the primary full yr of gross sales for the 2 fashions, and quantity jumped by an additional 22%. The GM6 Metropolis went on to be essentially the most profitable technology ever, outselling its arch-rival on the finish of its lifecycle.

Everybody wants a breather after a dash, and 2016 was one for Honda, earlier than it continued the journey to the height. The model’s 2017 gross sales of 109,511 items (19% up) wasn’t simply its private finest, however the highest annual complete ever for a non-national model in Malaysia. The truth that Honda doesn’t promote pick-up vans like the remainder of its NN rivals, makes its gross sales feats much more spectacular.

Honda began vibrant and early in January 2017 with the launch of the BR-V, earlier than the new promoting Metropolis and Jazz duo had been facelifted (Hybrid choice added). The present-gen CR-V joined the vary mid yr, whereas 2017 was additionally the primary full yr of gross sales for the landmark Civic FC, which debut in mid-2016. Fairly some yr it was for the corporate.

When you think about the current momentum swing in direction of nationwide automobiles, Honda’s 2017 feat, or 100k gross sales for that matter, is unlikely to be ever repeated once more by a international make in Malaysia.

What goes up…

Should come down. Gross sales in 2018 retreated barely (6.6%) from the earlier yr’s excessive level, however had been nonetheless above the 100k mark. 2019 was a troubled yr for Honda, which was severely affected by product delays that had been out of its management. The facelift of the very profitable HR-V crammed up many vacant carparks earlier than it was lastly launched, and the Civic facelift didn’t make its authentic 2019 launch schedule (they lastly received it out in February 2020, after which MCO occurred). Gross sales fell to the bottom level in 5 years (85,418).

If previously, the Japanese had been encroaching into P1/P2’s territory with entry-level choices, the other is true now. Proton’s Geely-powered rejuvenation has seen it gone upmarket – the trendy X50 and X70 SUVs are direct rivals to the HR-V and CR-V, with nationwide worth perks to sweeten the deal. If not for the X fashions, certainly many of those new Proton prospects would have gone down the default SUV street, and that path results in Honda.

You possibly can swap out X50/X70 and HR-V/CR-V for Myvi and Jazz, too. Perodua hit the ball out of the park with the third-generation Myvi that surfaced in late 2017. Regardless of the Myvi loses out in model energy and refinement to the Jazz, it makes up for it in gear. Priced RM20k lower than the bottom Jazz S, the highest Myvi AV trounced the entry Honda in comfort (LED headlamps, touchscreen HU, digital AC) and security equipment (six vs 4 airbags, VSA, AEB). Much more for lots much less – many heads had been turned.

Similar to high and low tides, carmakers don’t come out with winners on a regular basis, and the great fashions are likely to clump collectively like a striker’s purple patch, vice versa (assume Civic FB and the fourth-gen CR-V). Generally, the life cycles of varied fashions come collectively properly and opponents are usually not at their strongest; with that perfect combo, Honda Malaysia conjured up an excellent crew objective in 2017. One for the ages, however most likely by no means once more.

Whereas it retained the No.1 non-national spot final yr, Honda’s 60,468 items bought in 2020 was its lowest for the reason that days that it was duelling with Nissan. Is there a means again up? Properly, this yr would be the first full yr of gross sales for the most recent Metropolis, and the brand new Jazz-replacing Metropolis Hatchback may arrive to bolster the assault, so we’ll see.

Did Toyota attempt exhausting sufficient?

If that sharp drop was Honda, the highest non-national model, then the gross sales of the others will need to have dived into the bottom? Probably not. Toyota’s ache occurred in 2014-2016 and it has had the previous couple of years to mattress into a brand new regular. Nissan’s N17 Almera increase lasted them 4 years earlier than a stepped decline started.

As you’ll be able to see from the chart on high, Toyota was on a excessive degree within the first half of the last decade, even breaching 100k twice. Nevertheless, since dropping out to Honda in 2015, its decline was swift – 2016 gross sales was down by a whopping 32% to 63,757 items, and it has stayed within the 60-70k band ever since, save for 2020’s small dip (58,501 items).

Enjoying a significant function within the fortunes of the carmakers listed below are their B-segment sedans. Ship one which flies off the showroom flooring and your bonus subsequent yr shall be fats, usually. Get it unsuitable nonetheless, and your rival with the extra well-liked B-sedan will take benefit.

Toyota didn’t get the third-generation Vios unsuitable per se. Actually, the XP150 – nicknamed “keli” (Malay for catfish) for the form of its mouth/whiskers – even beat the GM6 Metropolis to the launch tape by almost half a yr when it surfaced in October 2013. The physique was new, however this Vios carried over the long-serving 1NZ-FE and 4AT powertrain combo, and the two,550 mm wheelbase.

Toyota’s bread and butter automobile lastly acquired a brand new engine in 2016, giving the 1NZ-FE (which has been within the Vios for the reason that nameplate was born in 2003!) a well-deserved retirement. As an alternative is the NR sequence engine shared with Perodua. In 2019, the Vios acquired a significant overhaul, which gave it the look of a brand new gen. No adjustments underneath the pores and skin, however that’s to be anticipated because the powertrain was up to date in 2016. One other facelift was launched in December 2020.

If it sounds complicated, you’re not alone. As an alternative of a clear-cut technology with a facelift three/4 years on – which is the default life cycle – Toyota opted for a sequence of operating and overlapping adjustments. Even because the acquainted Vios troopers on with new garments for 2021, the Honda Metropolis – which debut later than the Vios within the earlier spherical – has moved into an all-new technology.

We’re in no place to inform Toyota that they performed it unsuitable, however the truth that the previous-gen Honda Metropolis comfortably outsold the then newly-overhauled Vios in its last full yr of gross sales (2019), factors to the victor. It’s positively not for the dearth of promoting on Toyota’s half (the Vios had a star-studded one-make race as a part of an annual nationwide roadshow), so maybe Malaysian carbuyers needed extra from the product? What do you assume?

Keep in mind that UMW Toyota Motor – with Malaysia’s comparatively small quantity subsequent to giants Thailand and Indonesia – received’t have the largest say on the ASEAN desk (to place it flippantly), and lots of issues are determined en bloc, regionally.

Metropolis vs Vios apart, Honda had a giant gross sales contributor over the previous few years in form of the HR-V. When the compact SUV arrived in 2015, it single-handedly created its personal phase in Malaysia, even when B-SUVs existed earlier than that. Toyota’s reply to the HR-V was the C-HR, a positive automobile and product hampered by CBU-derived worth/spec points. It made negligible influence to the general gross sales trigger consequently.

One other two sizeable segments that had been free runs for Honda is the C-segment SUV – the place the CR-V is a category stalwart (Toyota’s RAV4 lastly arrived in 2020, however as an costly CBU Japan import) – and the B-segment hatchback, the place the Jazz has been an excellent wingman for the Metropolis. In the meantime, the Toyota Yaris hatch has been an occasional silent customer in dear CBU kind till 2019, when immediately’s CKD mannequin was launched with aggressive pricing.

Put two and two collectively and it seems as if Toyota handed the initiative to Honda, who then took it with each palms and ran as quick because it might.

A two-speed race

Should you take a look at the chart, the large hole between Honda and Toyota has all however evaporated and it’s all to play for from right here on. Additional down, Nissan’s regular decline from the N17 Almera-induced excessive (2013) has seen gross sales drop to Mazda’s ranges in 2020 (14,160 vs 12,141). It now seems to be like a two-speed non-national race – Honda vs Toyota for third/fourth, and Nissan vs Mazda for fifth/sixth.

That type of quantity can be fairly worrying for Nissan, as Tan Chong’s enterprise footprint in Malaysia is far bigger than its 2020 gross sales would recommend. The long-time native accomplice of the Yokohama carmaker has a variety of locally-assembled fashions and operates two factories in Malaysia. If that is the brand new regular quantity for the model, one wonders if it’s sustainable for TC – maybe that’s why the corporate is now wanting in direction of China for diversification.

It’s a complete story by itself, Nissan in Malaysia, however the model’s present state might be a combo of the principal’s product technique for the area and the native accomplice’s occasional perceived hesitancy. The latter is usually used as some extent of criticism, however one should keep in mind that Tan Chong just isn’t Nissan, however basically a buyer of the principal – you’ve received to commit sure numbers to get a product at a aggressive worth, and if that wager doesn’t repay, the losses are all on you because the assembler/distributor.

What in regards to the new Almera? It seems to be the most effective of the B-segment lot (to me a minimum of), and there’s even tech to match (downsized turbo engine, lively security equipment), not one thing you’d say in regards to the dumpy previous mannequin. However sadly, the worth has additionally crept up (RM80k onwards), so it’s now not the default finances choice. Right here’s hoping the N18 does properly.

Issues couldn’t be extra totally different for Mazda and Bermaz. One of many few manufacturers to have recorded a development in 2020, final yr’s quantity is double that of a decade in the past. In contrast to Nissan, Mazda is essentially a CBU firm, with solely the CX-5 and CX-8 SUVs – its quantity sellers – being regionally assembled for home and ASEAN consumption. Additionally totally different from Nissan-ETCM’s case is Mazda Motor Corp having a majority stake within the manufacturing enterprise in Malaysia.

In city areas and extra prosperous neighbourhoods, Mazdas are a part of the road furnishings. Many most likely don’t realise this, however stroll round Tokyo or Osaka and also you’ll battle to identify a Mazda – even luxurious imports are extra frequent there. I can think about executives visiting KL from Hiroshima being in awe of the model’s outsized presence in Malaysia.

With out the dimensions to CKD every little thing, Mazda trades on design and premium positioning – with the slice of the non-national pie anticipated to proceed shrinking over the approaching years, Mazda’s lifestyle in Malaysia may do it good. With the boldness accrued from rising the Mazda model in Malaysia, Bermaz is now teaming up with Berjaya to repeat the trick with Peugeot.

With Honda-Toyota and Nissan-Mazda now neck-to-neck within the gross sales league, who will you set your cash on to prevail on the finish of 2021? And with Perodua’s anticipated D55L SUV coming quickly, in addition to the Proton X50‘s first full yr of gross sales to account for, how far more will the non-national pie – now at 38% – shrink? It is going to be an fascinating yr forward, that’s for certain.