In 2024, collision severity declined by 2.5% year-over-year (YoY) whereas property injury severity elevated by 2.5%, and bodily harm severity jumped 9.2%, in response to LexisNexis Threat Options.

LexisNexis additionally predicts that preliminary indications are charge ranges will return to extra regular ranges this 12 months, in response to the 2025 U.S Auto Insurance coverage Traits Report. It reveals combination 2024 market knowledge on client driving patterns, auto insurance coverage purchasing developments, declare frequency and severity, and client responses to charge will increase.

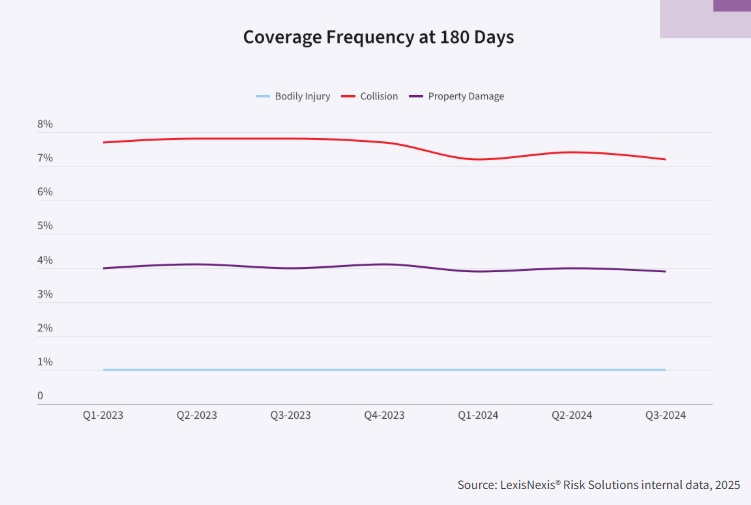

Collision frequency moved from 7.8% within the first three quarters of 2023 to 7.3% in the identical interval in 2024. On condition that collision frequency remained at 8% or increased for a lot of 2022, this decline is now a pattern, LexisNexis wrote.

Property injury frequency additionally declined, shifting from 4.1% within the first three quarters of 2023 to three.9% over the identical interval in 2024. This protection has not seen a frequency beneath 4% since Q1 2021, in response to the report.

Bodily harm frequency stayed the identical, at 1%, the place it has been for a number of consecutive quarters.

Insurance coverage charge will increase are starting to ease as market situations soften, rising 10% YoY in 2024 in comparison with 15% in 2023. Nonetheless, general business charge ranges elevated by 35% from January 2022 to the top of 2024.

“LexisNexis Threat Options notes that in 2025, tariffs could issue into how insurers contemplate charges,” the report states. “Whereas the market wouldn’t anticipate the magnitude of exercise seen between 2022 by way of 2024, tariffs, in the event that they stick, might set off a ripple impact of average charge will increase with implications throughout the business.”

Insurer profitability can also be bettering, with direct written premiums rising 13.6% to $359 billion, barely lower than the 14% development in 2023, and incurred loss ratios improved steadily all year long. LexisNexis says this permits some carriers to pursue development methods and file for charge decreases.

“The mixture of those two components allowed these insurers who returned to profitability to take a extra surgical and balanced strategy to charge adjustments, with many submitting for charge decreases for the primary time in years,” LexisNexis mentioned.

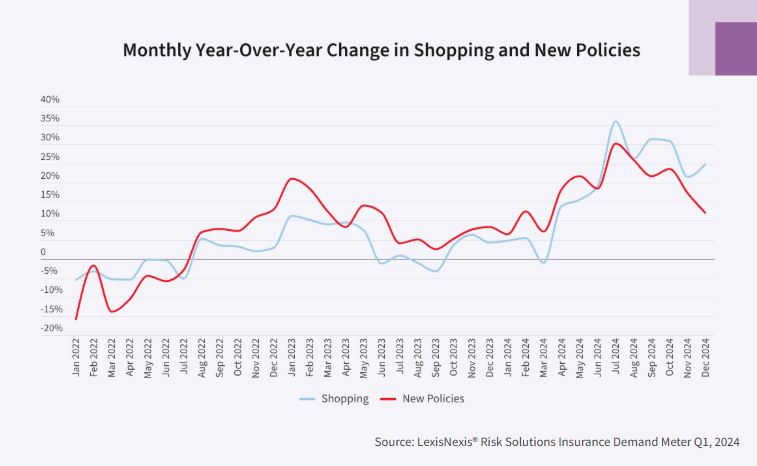

Coverage purchasing reached an all-time excessive, with greater than 45% of insurance policies in power shopped not less than as soon as by year-end.

Older and long-tenured policyholders led the purchasing pattern, with customers aged 66 and older purchasing and switching at a better charge than some other age group. Purchasing amongst those that have been with an insurer for 10 or extra years rose 35% YoY, with the speed of high-survivability buyers hitting 40% by the top of 2024.

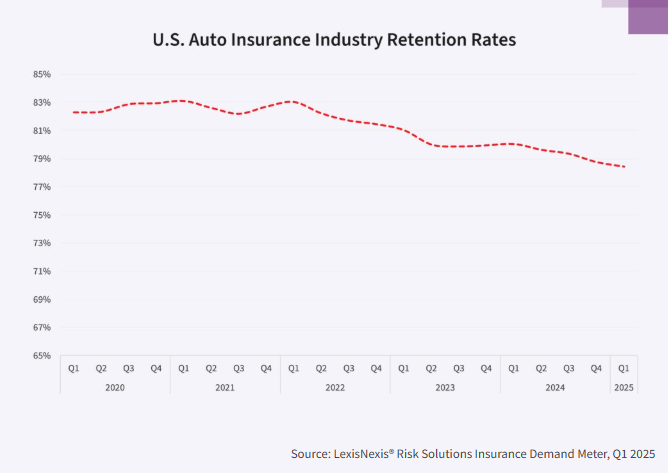

“As long-tenured customers proceed to buy and doubtlessly swap their insurance coverage insurance policies, insurers could need to deal with their retention methods,” a press launch states. “Since 2021, retention has decreased 5 proportion factors to 78%, leading to a 22% enhance in coverage churn.”

The report provides that new enterprise development outpaced auto coverage purchasing within the first half of the 12 months.

“As insurers staggered the timing of charge will increase throughout states, customers discovered favorable offers,” the report states. “Within the second half of the 12 months, purchasing outpaced switching. This was probably attributable to insurers implementing increased charges over time, making it more durable for buyers to search out engaging offers.”

Jeff Batiste, LexisNexis Threat Options U.S. auto and residential insurance coverage senior vp and normal supervisor, mentioned within the press launch that auto insurers proceed to navigate a dynamic market.

“The mixture of the market softening and a return to profitability presents a possible new chapter for the business as insurers encounter a client base that’s extra keen than ever to buy offers,” he mentioned. “Nonetheless, that is the market as we perceive it now, and we may be seeing a distinct image in a few months.

“Insurers who can shortly consider shifting developments and adapt pricing fashions ought to have a aggressive benefit, enabling them to cost threat extra precisely and shortly, which also needs to set themselves up for extra success as these developments impacting the business persist.”

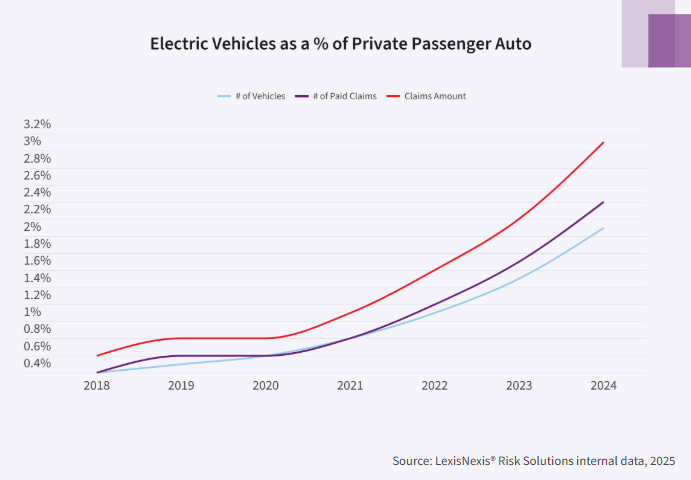

In accordance with LexisNexis, transitioning to electrical automobiles (EVs) additionally comes with new dangers, as drivers skilled a 14% rise in declare frequency.

In 2024, 1.57 million EVs had been offered within the U.S., an 8.9% enhance in comparison with 2023. This proportion is increased than the two.6% development throughout the identical interval of all light-duty automobiles — vehicles, vans, SUVs, and pickup vehicles that weigh 8,500 kilos or much less, in response to the report.

The variety of insured EVs grew by 40% to five.6 million final 12 months, which is far increased than the 1.8% development within the variety of non-public passenger autos insured throughout the identical interval.

The report additionally analyzes driving violations. LexisNexis notes that whereas the Nationwide Freeway Visitors Security Administration (NHTSA) reported 2024 site visitors fatalities decreased by 3.8% to 39,345 in comparison with 2023, that was nonetheless 11% increased than the common for the last decade previous the COVID-19 pandemic.

Total, site visitors violations elevated by 17% YoY, and nationwide charges surpassed these in 2019. Main rushing violations rose 16% YoY (38% increased since 2019), and minor rushing violations elevated 25% YoY (21% increased since 2019).

Driving beneath the affect elevated by 8% over 2023 ranges, with drivers aged 66-90 experiencing the biggest bounce in DUI violations. Nonetheless, drivers between the ages of 26 and 35 make up the biggest proportion of general DUI violation volumes, in response to LexisNexis.

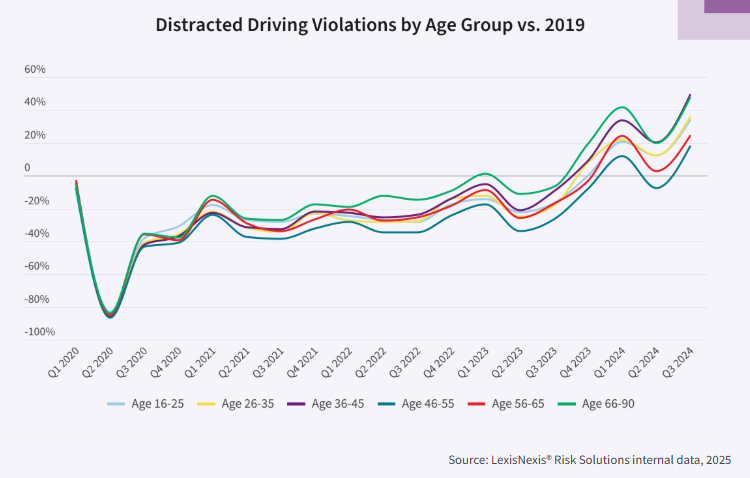

Cellphone use whereas driving continues as a big contributor to distracted driving, with texting whereas driving remaining notably harmful, in response to the report. Many states have enacted and strengthened distracted driving legal guidelines, together with bans on handheld system use and elevated penalties for violations.

The variety of drivers with distracted driving violations elevated by 50% throughout the first three quarters of 2024 in comparison with the identical interval in 2023.

Pictures

Featured picture credit score: Cameris/iStock

Share This: