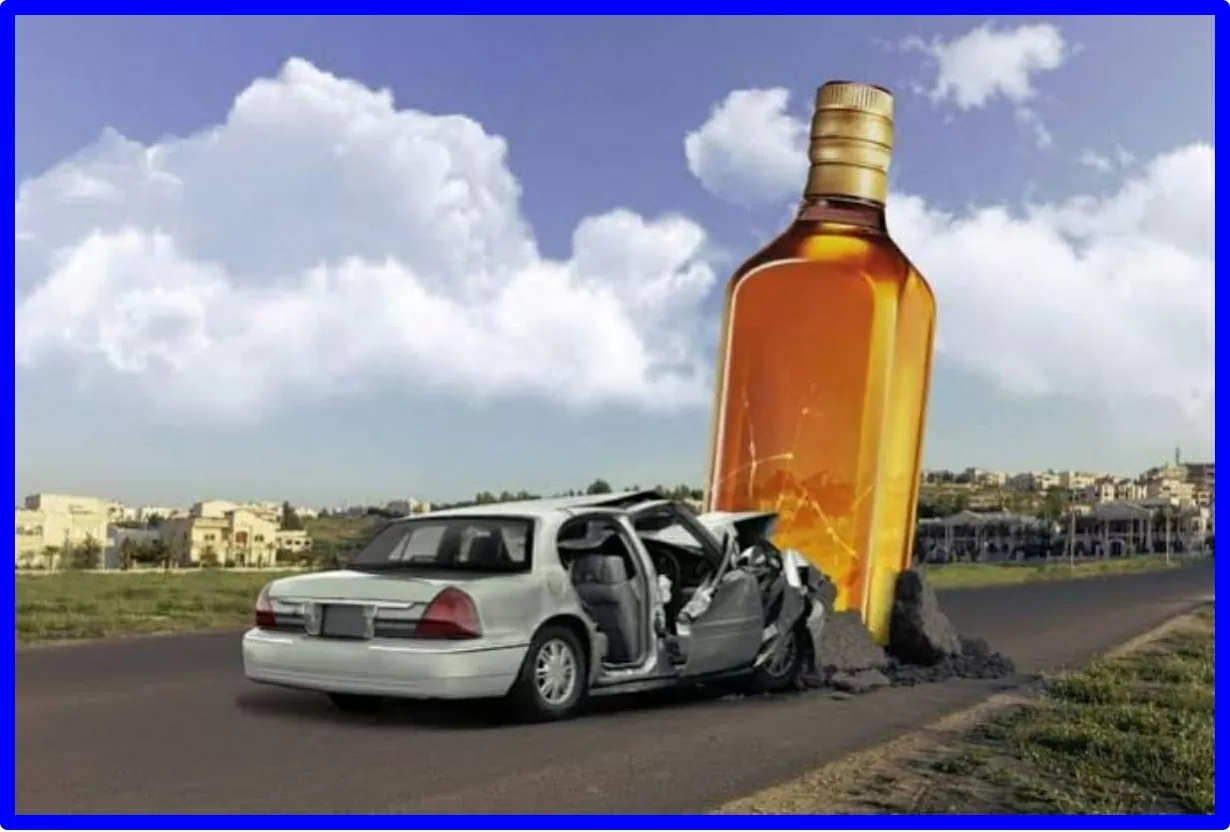

In a big ruling, the Madras Excessive Courtroom has clarified that insurance coverage corporations stay liable to pay compensation to the household of a deceased sufferer, even when the driving force accountable for the accident was drunk. This resolution brings reduction to victims’ households who in any other case may need been denied compensation because of technicalities in insurance coverage insurance policies.

The case was heard by Justice M. Dhandapani, who referred to an analogous verdict from the Kerala Excessive Courtroom in Muhammed Rashid @ Rashid vs. Girivasan E.Okay. The Kerala court docket had beforehand dominated that regardless of a clause within the insurance coverage coverage prohibiting driving underneath the affect, insurers are obligated to compensate victims, with the proper to get better the quantity from the insured later. Aligning with this precedent, the Madras Excessive Courtroom directed the insurance coverage firm to first deposit the compensation quantity after which search restoration from the automobile proprietor if obligatory.

The case concerned a tragic incident from December 30, 2017, the place Rajasekaran, a 37-year-old man, was fatally struck by a van whereas strolling on Thiruneermalai Most important Street, Chennai. Rajasekaran’s household had sought compensation of ₹65 lakh however was awarded solely ₹27,65,300 by the Motor Accident Claims Tribunal (MACT), which additionally exempted the insurance coverage firm, citing the driving force’s intoxication.

Disagreeing with the MACT’s verdict, the household appealed, arguing that the tribunal’s resolution was flawed and the compensation insufficient. Additionally they identified that the deceased was incomes ₹700 per day, however the tribunal had fastened his earnings at a a lot decrease determine of ₹13,700 monthly. The Excessive Courtroom discovered benefit in these arguments, elevated the month-to-month earnings estimate to ₹15,000, and enhanced the full compensation to ₹30,25,000, together with 7.5% annual curiosity.

Justice Dhandapani firmly held that victims’ households mustn’t undergo because of coverage violations by drivers, emphasizing the insurance coverage firm’s duty to compensate claimants promptly. The court docket ordered the insurance coverage firm to deposit the improved compensation inside six weeks and granted them the freedom to get better the quantity from the accountable social gathering following authorized procedures.

This verdict reinforces the safety obtainable to accident victims underneath Indian regulation, making certain monetary assist to affected households whatever the driver’s conduct.