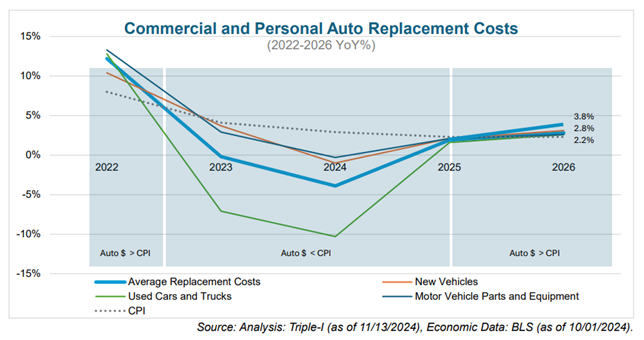

Triple-I expects the tempo of enhance in common property/casualty insurance coverage alternative prices to exceed will increase within the shopper value index in 2025 and past as auto alternative prices rise for the primary time since 2022 and CPI continues to say no.

Triple-I’s alternative price index for private and industrial auto tracks modifications within the value of autos, elements, and tools that make up the alternative prices going through insurance coverage carriers offering collision insurance coverage for each private and industrial motor autos. These prices – which have elevated by as a lot as 30 p.c over the previous 5 years – are anticipated to extend by 2.8 p.c in 2025.

The index combines alternative prices knowledge for motor autos by age and for elements and tools from the CPI for All City Shoppers. These price drivers have been chosen from a wider collection of U.S. authorities sources, together with the Bureau of Labor Statistics, Bureau of Financial Evaluation, Federal Reserve, Census Bureau, and the Departments of Labor, Transportation, and Vitality.

“Whereas we anticipate the financial drivers of P/C insurance coverage efficiency to proceed enhancing 2025, efficiency shall be constrained by alternative price will increase, rising pure disaster losses, and geopolitical uncertainty,” mentioned Triple-I Chief Economist Dr. Michel Léonard.