Suzhou: Dominant within the electrical automobile sector, Chinese language firms have been quietly consolidating their place within the lesser-watched trucking scene — however international tariffs and a perceived high quality hole might sign roadblocks forward, consultants warn.

The home provide chain and low-price technique that helped make China’s EV automobile business world-leading are being leveraged by established automakers and start-ups alike, aiming to equally rework trucking.

Electrical vehicles presently characterize lower than one % of truck gross sales worldwide, in line with the Worldwide Power Company (IEA) — with China making up 70 % of these gross sales in 2023.

However the company mentioned it was “optimistic” coverage and know-how developments would see extra widespread adoption within the subsequent 10 years.

“This business, I consider, is ripe for disruption,” Han Wen, the founding father of start-up Windrose, advised AFP on a manufacturing unit ground as the corporate’s first autos for supply had been assembled behind him.

Fleets of electrical heavy items autos from China have been rising internationally, whilst Western international locations goal the nation’s EV automobiles with heavy sanctions.

Chinese language firms like BYD and Beiqi Foton have shipped vehicles to international locations together with Italy, Poland, Spain and Mexico, and have opened meeting vegetation world wide.

“China’s vehicles are usually cost-competitive in rising markets,” Stephen Dyer, from consulting agency AlixPartners, advised AFP.

“For mature markets, efficiency and sturdiness don’t but meet the wants of most prospects, however that’s altering.”

In terms of emissions, “heavy-duty vehicles are thought-about one of many harder to abate transport segments (after aviation and transport)”, IEA analyst Elizabeth Connelly advised AFP.

– Battery points –

A serious problem is the trade-off between battery measurement and vary.

“The bigger the battery, the longer the vary. However the bigger the battery, the heavier the truck… and the more severe the gasoline economic system,” Connelly mentioned.

Chinese language producers have been seen as producing decrease high quality merchandise than international counterparts.

“Traditionally, Chinese language vehicles tended to have a shorter helpful lifecycle than European or Japanese vehicles,” AlixPartners’ Dyer advised AFP.

Whereas that notion is altering, China’s flagship firms nonetheless lag rivals on elements like vary and battery capability.

In keeping with the Zero-Emission Expertise Stock, the median Chinese language heavy responsibility truck vary is 250 kilometres (155 miles), in contrast with 322 km in the US.

BYD — which in October beat Tesla in quarterly income for the primary time — says its 8TT mannequin’s vary is 200 kilometres, in contrast with the 800 kilometres promised by Tesla’s Semi truck.

However Chinese language producers might shut the hole rapidly.

Han’s Windrose says its semi-trucks can go as much as 670 kilometres on a single cost.

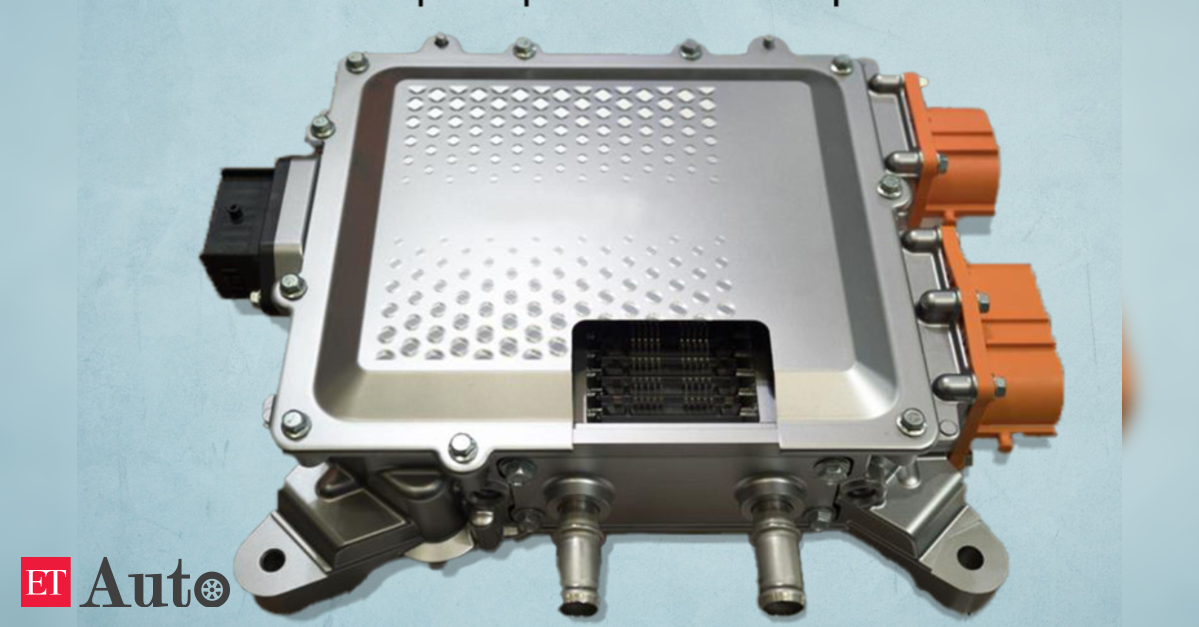

In the meantime, battery big CATL has rolled out truck battery-swapping services — the place drained models might be instantly changed, eliminating charging time altogether.

China’s present EV ecosystem is a large benefit.

“We’re very fortunate to have the Chinese language provide chain (for EVs),” mentioned Han, noting Windrose was utilizing an electrical bus firm’s manufacturing unit to construct its vehicles.

“There isn’t any doubt that China additionally can have an edge on the electrification of industrial quality vehicles.”

– ‘Not regular occasions’ –

Extra unpredictable are the testy geopolitical waters the sector dangers stalling in.

This 12 months has seen vital buying and selling companions together with the European Union and the US impose hefty tariffs on Chinese language EV automobiles, saying Beijing’s state assist to automakers undercut their very own corporations.

China refutes this, however as its EV truck footprint grows globally, so might the chance of comparable motion being taken.

“Governments in potential export markets wish to shield their native industries,” Sam Fiorani, at AutoForecast Options, advised AFP.

US President-elect Donald Trump has promised enormous tariff hikes on Chinese language imports as soon as he takes workplace.

“Since EV truck quantity is smaller than passenger EVs, there’s a probability that EV vehicles would fall a little bit below the radar in regular occasions,” AlixPartners’ Dyer mentioned.

However “these will not be ‘regular occasions’ anymore and something Chinese language is excessive profile within the US authorities presently”, he added.

Some firms have already taken steps that would mitigate this threat.

BYD proudly touts its vehicles as being “assembled by union employees in Lancaster, California”, whereas it has introduced plans to construct a manufacturing unit in Mexico, and has vegetation in Hungary and Romania.

Windrose’s Han advised AFP the agency has consciously unfold its operations throughout a number of international locations, shifting key headquarters to Belgium earlier this 12 months.

“We do embrace the truth that each main market would really like its personal home provide chain of EV,” he advised AFP.

However he added: “You need to begin in China. We then attempt to transfer the availability chain globally… However you must begin in China. There isn’t any various.”

tjx/reb/dan