In an unassuming white and blue workplace constructing in Freeport, just a few miles into Nassau County, sits the headquarters of American Transit Insurance coverage Co.

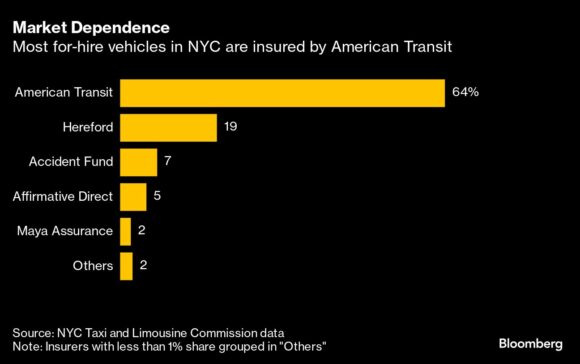

The 52-year-old, family-owned agency is hardly a family title, however it’s important to how New Yorkers zip across the metropolis. American Transit, often known as ATIC, insures roughly 60% of New York Metropolis’s greater than 117,000 business taxis, livery cabs, black automobiles and rideshare autos.

It’s additionally bancrupt.

Run by Ralph Bisceglia, ATIC has for many years been the dominant participant in New York Metropolis’s business automobile insurance coverage market, the biggest within the nation, providing cabbies premiums far decrease than different insurers. Within the second quarter, it posted greater than $700 million in web losses, in keeping with a submitting with the Nationwide Affiliation of Insurance coverage Commissioners.

“To see this sort of lack of this dimension — there are few precedents,” stated Tim Zawacki, a senior analyst at S&P International Market Intelligence, who has lined the insurance coverage trade for 25 years. “If this firm goes to be unable to proceed enterprise, there’s going to be vital fallout when it comes to who’s going to insure all of those drivers.”

Christopher Ryan, ATIC’s chief monetary officer, and different firm representatives didn’t reply to a number of e-mail and phone requests for remark.

The losses observe years of warnings from trade analysts, and disagreements between ATIC and its third get together actuary. The corporate’s reserves have been thought of poor for many years, stated Zawacki, and the issue has come to a head as the corporate wrestles with bigger declare sizes pushed by larger settlements in addition to jury and arbitration awards. A possible ATIC failure would imply tens of 1000’s of taxi drivers with out insurance coverage, throwing town’s advanced transit ecosystem into turmoil, taxi trade specialists and former regulators stated.

The insurer’s losses grew so massive that they’ve crossed a threshold referred to as a “necessary management degree occasion,” in keeping with a Dec. 31 report by Huggins Actuarial Companies, a advisor employed by ATIC. New York’s Division of Monetary Companies — which regulates insurers — might now be compelled to step in to put the corporate into receivership or liquidate it.

DFS informed Bloomberg it has been “working with the corporate and different stakeholders to deal with these longstanding monetary points, and defend drivers, passengers and the steadiness of the New York livery insurance coverage market.”

‘Too Large to Fail’

“There’s a notion that they’re too huge to fail,” stated Andrew Don, chief working officer of Analysis Underwriters, a transportation insurance coverage dealer. If that occurred, “there can be a big void within the capability to get a taxi or an Uber or a Lyft or a limo in New York as all of those autos would out of the blue be with out insurance coverage.”

“The one different insurance coverage carriers that may have the ability to decide them up at present might battle with the amount of enterprise,” Don stated. In that case, “each taxi driver or limo driver goes to have a big enhance of their insurance coverage premium” as charges regulate to mirror actual threat, he stated. That would upend an trade already battered by headwinds together with elevated competitors and plunging medallion values.

In response to questions, town’s Taxi and Limousine Fee stated it’s in shut contact with the DFS and meets with it repeatedly “to offer experience and emphasize the significance of reasonably priced insurance coverage to the trade.” It directed Bloomberg to the DFS for touch upon ATIC.

Whereas ATIC is required by the state’s DFS to undergo an examination each 5 years, there are not any publicly obtainable examination stories for the corporate. A 1986 DFS analysis obtained by Bloomberg described ATIC as bancrupt by $6 million.

“DFS has to step in and do one thing,” stated Matthew Daus, a accomplice at regulation agency Windels Marx and the previous chairman and commissioner of New York Metropolis’s Taxi and Limousine Fee. The corporate’s newest monetary submitting paints an image so dire that it’s “creating unrest within the trade,” stated Daus, who based Windels Marx’s Transportation Follow Group.

ATIC has been underpricing insurance coverage for many years, snapping up enterprise from opponents, Daus and different transit and insurance coverage trade officers informed Bloomberg.

“The premiums that they had been charging weren’t commensurate with the danger they had been taking over,” Analysis Underwriters’s Don stated.

It raises questions over ATIC’s capability to pay claims. Uber Applied sciences Inc. sued ATIC in federal courtroom in February, accusing the insurer of “a sample and observe of failing to stick to affordable claims-handling practices and failing to fairly resolve claims,” leading to 23 lawsuits introduced towards Uber and its drivers over crashes involving bodily accidents. That left the ride-share large to pay “substantial quantities” to defend itself.

Learn extra: Uber Sues Insurer for Refusing to Cowl NYC Drivers in Crashes

ATIC attorneys denied the allegations, and the go well with is ongoing.

In 2021, the actuarial advisor Huggins discovered the corporate was roughly $500 million wanting the cash thought of essential to cowl its unpaid losses and loss-adjustment bills. That form of willpower, S&P reported on the time, is exceptionally uncommon.

“If corrective motion shouldn’t be efficiently carried out by the corporate and additional hostile growth continues, the likelihood exists the corporate might be positioned in some type of receivership or liquidation,” Ronald Kuehn, a advisor at Huggins, wrote.

ATIC’s Ryan responded to S&P that he didn’t agree with Huggins’ opinion due to the “distinctive nature” of the New York market.

Zawacki described the most recent losses as “fairly staggering when it comes to its magnitude” and stated it’ll create distinctive challenges for the regulators.

“Any resolution they make goes to have vital implications for passengers and drivers,” he stated.

Photograph: Taxis wait to select up commuters outdoors Pennsylvania Station in New York.

Copyright 2024 Bloomberg.

Matters

Carriers

New York