Vehicles weaving via site visitors at 90 miles an hour beneath billboards touting private harm attorneys are a truth of life in a lot of Connecticut in 2024 — as is sharing the street with a rising fleet of electrical vehicles and different high-tech autos.

Consultants say you possibly can blame these three elements for a lot of the spike in auto insurance coverage premiums in Connecticut this yr: Harmful driving, hungry attorneys and more and more difficult vehicles on the state’s roads are costing us all cash.

Permitted automotive insurance coverage charges jumped by 10.7 p.c in Connecticut in 2024, greater than double the nationwide common hike of 4.8 p.c, in response to information from S&P International Market Intelligence. The rise displays charges charged by the ten largest corporations, representing 80 p.c of the auto insurance coverage market.

Article continues beneath this advert

“There’s a purpose that individuals are beginning to get cranky,” stated Brian P. Sullivan, an auto insurance coverage business analyst who collated the S&P information. “Within the final two years, Connecticut has seen large fee will increase.”

Automobile insurance coverage charges nationwide have risen steadily for a decade however have spiked since 2022, in response to U.S. Bureau of Labor Statistics information.

However premiums can be loads increased if auto insurers might get the charges that they need while you issue of their losses in recent times. Connecticut residents are inclined to drive newer vehicles which are more and more costly to restore, and a surge in critical accidents within the state is taking a better toll in each lives and prices, consultants say.

Article continues beneath this advert

“A very powerful factor to know is that auto insurance coverage costs go up when claims go up, that’s the No. 1 driver,” Sullivan stated. “So the query isn’t a lot why your value goes up, it’s why claims are going up.”

Harmful driving outlasts pandemic

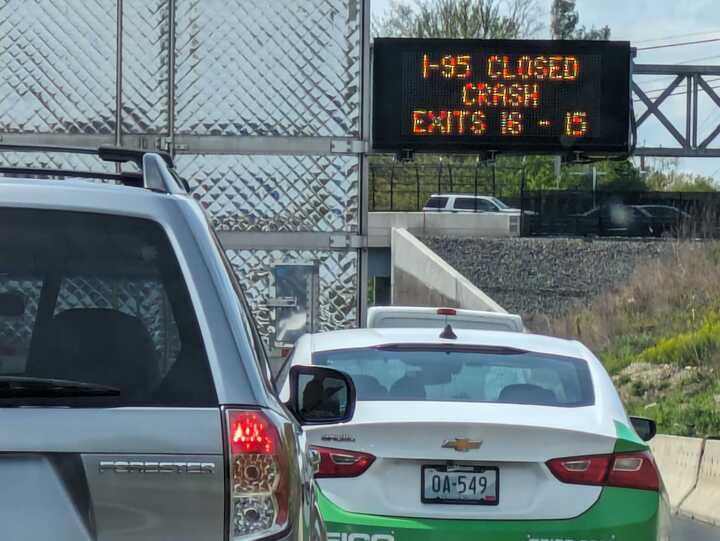

Spending a while driving on the interstate highways in Connecticut shortly solutions one a part of why automotive insurance coverage claims are increased: Drivers are working wild on the market. There’s extra rushing, distracted driving and disrespect of pedestrians and work zones. Unhealthy habits picked up driving on empty roads throughout the pandemic have continued nationwide, in response to security consultants.

A latest spate of wrong-way crashes and a collection of high-profile freeway deaths in Connecticut have highlighted the issue, with state lawmakers vowing extra enforcement on the roads.

Deaths on Connecticut roads surged to 366 in 2022 — the worst yr for site visitors fatalities since 1989, in response to the state Division of Transportation. Though the variety of deaths have dropped barely, rushing stays an issue.

Crashes at excessive velocity trigger extra deaths, critical accidents and harm, driving up prices for all concerned. And repairing that harm is extra expensive than ever as a result of sensors, batteries and computer systems now commonplace in newer vehicles.

Article continues beneath this advert

A windshield restore that might be achieved in a car parking zone for just a few hundred {dollars} a decade in the past now requires recalibration of sensors and hundreds of {dollars} in labor and elements. The employee who fixes that windshield is not a yard tinkerer who is sweet with a wrench, however a extremely expert technician with intensive coaching — and an hourly fee to match.

“Vehicles have gotten increasingly difficult each single day,” Sullivan stated. “On daily basis an older automotive with out sensors and issues like that’s being changed by a more moderen automotive which is way more tough to restore.”

‘Excellent storm’ hikes insurance coverage prices

The mixture of harmful driving and more and more complicated vehicles is creating “an ideal storm,” for each coverage holders and insurers,” stated Gregory Smolan, vice chairman for insurance coverage operations for AAA Northeast.

Article continues beneath this advert

“Easy accidents are costing much more, and on prime of that, you’re seeing folks driving at sooner speeds,” Somlan stated. “So losses which are occurring are literally inflicting extra harm and extra bodily harm.” AAA is becoming a member of with lawmakers to induce folks to decelerate and return to safer pre-pandemic driving habits, he stated.

One other issue driving up losses for insurers is auto theft, which has crept up in recent times in Connecticut, particularly in cities. Add to that intensifying storms which topple timber onto autos and trigger floods that may shortly and catastrophically harm vehicles.

“Individuals consider owners first once they consider (climate harm), however that additionally has an impression on autos,” Smolan stated. “We’ve even seen within the Northeast, which was very unusual previously, some hail.” The dents and windshield harm brought on by hail can value hundreds to repair and repairs are absolutely lined by complete insurance policies.

Though Connecticut has escaped main catastrophes to this point, traits towards extra damaging climate and better prices have an effect on all states, Sullivan stated. “That is nationwide, and no state is immune.”

Article continues beneath this advert

One other consider premium will increase pertains to these jokey billboards promoting private harm attorneys alongside the highways. Attorneys in personal observe are taking up extra accident instances than previously, additional driving up prices for insurers.

“The share of auto accidents that contain attorneys combating for the final nickel, partaking medical doctors and chiropractors to verify they’ll drive up the prices, that has risen considerably within the final a number of years,” Sullivan stated. “What was a fast and simple settlement is now a protracted and protracted battle.”

State regulators reasonable fee hikes

In all, Connecticut drivers are fairly lucky in having greater than 100 completely different corporations to select from when shopping for auto insurance coverage, stated George Bradner, assistant deputy commissioner and director of the Property & Casualty Division on the state Insurance coverage Division. States like Florida have seen an exodus by main auto insurers as a consequence of points round fraud and pure disasters — inflicting premiums to skyrocket.

Article continues beneath this advert

Insurers nonetheless wish to do enterprise in Connecticut, however don’t wish to lose cash within the course of.

“The business is coming in they usually’re displaying the losses,” Bradner stated. “We do have to be sure that the businesses are there … availability is vital.”

And while you consider the price of residing and our state’s love of high-tech vehicles, Connecticut is about in the course of the pack nationwide with regards to automotive insurance coverage affordability, in response to information from the Nationwide Affiliation of Insurance coverage Commissioners.

Connecticut ranked No. 26 amongst states in rating of auto insurance coverage prices as a proportion of common family earnings in 2022, the latest NAIC information out there. Residents of states like Louisiana, Florida and Mississippi pay probably the most in comparison with common incomes, and people in North Dakota, New Hampshire and Hawaii pay the least.

Article continues beneath this advert

Even with our comparatively excessive premiums, Connecticut’s insurance coverage division saved drivers $123 million in 2023 by holding down insurance coverage charges, Bradner stated. The state negotiates with insurers once they submit charges for approval to reasonable will increase.

“If we expect they’re being too aggressive on their traits, we push again on them,” Bradner stated. Since 2021, the state dialed again fee requests to the tune of $250 million in financial savings for auto insurance coverage clients.

With so many corporations vying for Connecticut’s auto insurance coverage enterprise, drivers can save by buying round, Bradners stated. If you happen to’ve been with an organization for some time with no accidents, strive bargaining with them for a decrease fee.

“We have now a really aggressive market in Connecticut,” Bradner stated. “However be sensible while you store. It’s a must to take into account all the pieces — the claims dealing with of an organization and their fame.”

Article continues beneath this advert

Considering value of residing and insurers’ losses in recent times, “Connecticut’s premiums are proper the place they need to be,” Sullivan stated. “Connecticut residents are struggling with increased costs as a result of all of the elements we mentioned are driving up the price of automotive insurance coverage.” As for charges taking place anytime quickly? “I can’t see a single purpose why they might within the close to time period,” Sullivan stated.

Smolan of AAA stated he understands the continued frustration of drivers going through escalating insurance coverage prices. AAA advises drivers to pay their premiums in full and bundle owners and auto protection to save lots of on insurance coverage. Opting to pay a better deductible may also decrease your premium.

“If I haven’t had a violation or I haven’t had an accident and my automotive’s a yr older, I ought to be paying much less, no more,” Smolan stated, echoing buyer issues about latest value will increase. “We’re attempting to do our greatest to coach them on the rationale why, however there’s completely frustration with of us. As a result of once more, it’s simply one other expense that’s rising.”

Article continues beneath this advert