TAMPA, Fla. — Indian insurance coverage specialist Tata AIG is increasing into area as the worldwide market reels from a string of heavy losses.

Tata AIG stated Could 13 it has began offering satellite tv for pc in-orbit third-party legal responsibility insurance coverage overlaying bodily damage and property harm, constructing on the 22-year-old firm’s experience within the aviation market.

Sushant Sarin, president of business enterprise at Tata AIG, a three way partnership between Indian conglomerate Tata Group and U.S.-based insurance coverage agency American Worldwide Group (AIG) with greater than 8,750 workers, stated it’s the first personal insurer in India to supply satellite-based protection.

“This revolutionary product caters to the rising wants of satellite tv for pc producers and operators within the Indian area sector, particularly within the wake of latest photo voltaic storm that highlights the potential hazards confronted by orbiting spacecraft,” Sarin stated.

“We’re assured that this may empower Indian satellite tv for pc corporations to function with better confidence and contribute to the nation’s spacefaring ambitions.”

Deepak Kumar, senior government vice chairman, stated Tata AIG will work with reinsurers internationally to dump danger.

Tata AIG plans to later present first-party property harm protection for satellite tv for pc and launch automobiles throughout pre-launch, launch, and in-orbit operations.

There are round 189 startups in India growing space-related companies, in line with Kumar, who can also be head of reinsurance, credit score and aviation insurance coverage on the group.

“These new entrants in area economic system are looking for monetary danger mitigation instruments to make sure sustainability of their operations,” he stated through e mail.

“Tata AIG could be a pure associate to such startup corporations.”

Turbulent occasions

Round $2 billion area insurance coverage claims have been reported over the past 12 months throughout 20 incidents, in line with Dubai-based underwriter Elseco, practically 10% of the estimated $23 billion worth of all insured belongings in orbit.

Most of those occasions occurred in 2023, a harrowing yr for the market that has raised questions on its capability to cowl future dangers.

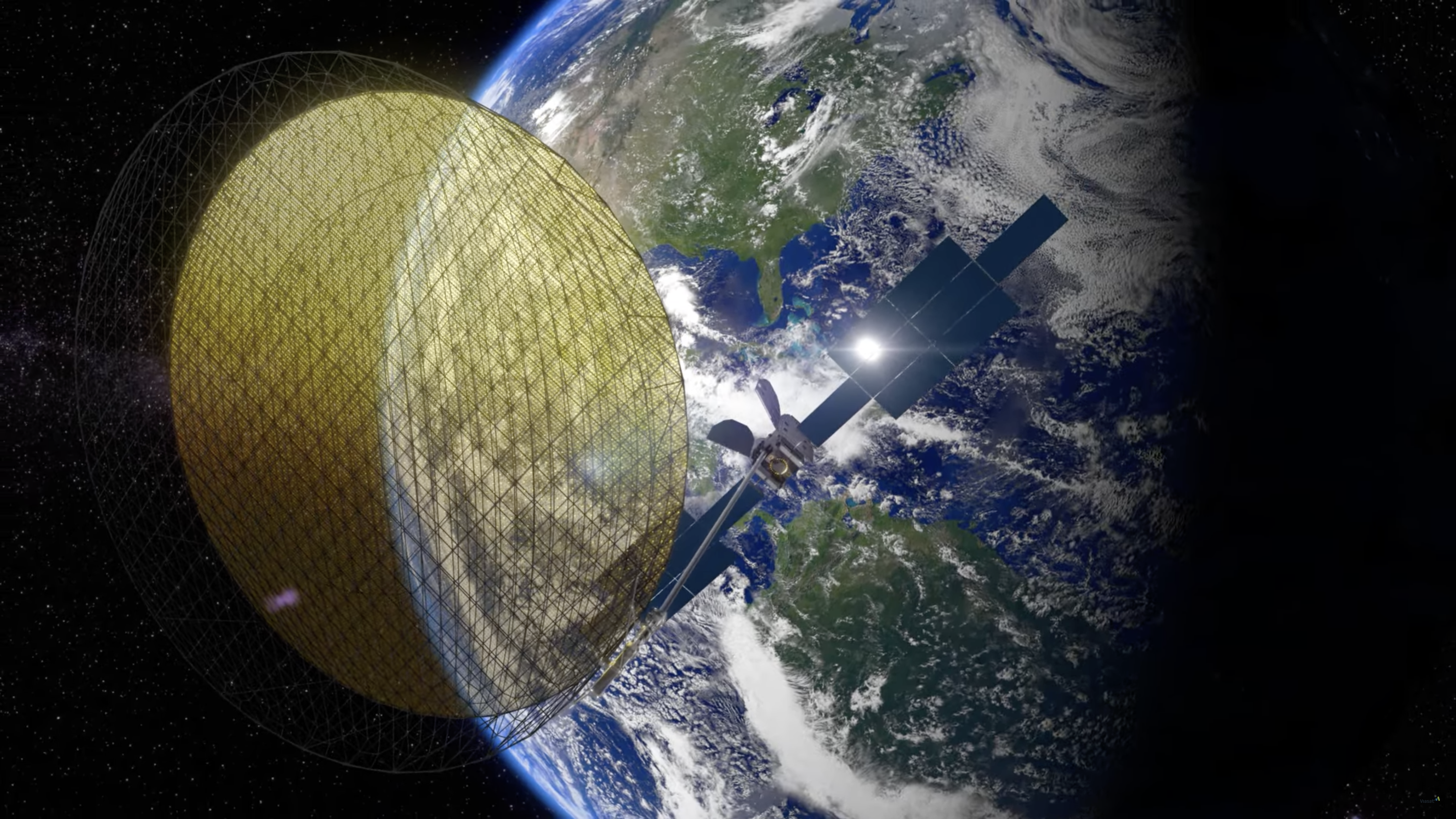

The failure of Viasat-3 and energy points affecting the primary 4 SES O3b mPower satellites are among the many most high-profile claims.

Insurance coverage charges jumped as a lot as 100% for some area dangers within the final three months of 2023 in contrast with the identical interval in 2022, Elseco chair and CEO Laurent Lemaire stated.

Lemaire stated charges proceed to soar as roughly $1 billion in claims have come by means of because the begin of this yr.

Nonetheless, he stated charges stay round 37% decrease than in late 2002 after declining over the previous couple of a long time.

Tata AIG’s Kumar stated: “Whereas there have been few massive losses on this section, the House Insurance coverage market will work collectively to make sure continuity of coverages.”

Rising area exercise additionally will increase demand for insurance coverage, he added, bringing in additional revenue and making the market extra sustainable.

He pointed to how India has been enjoyable overseas funding guidelines amongst different measures to hunt a bigger share of the worldwide area economic system, at present estimated at round 2%.