A Lincoln-based, veteran-owned insurance coverage firm needs present and potential shoppers to grasp why they could be paying an excessive amount of for his or her private and/or enterprise protection. Usually occasions, it has much less to do with the businesses that service their insurers and extra to do with the place they reside.

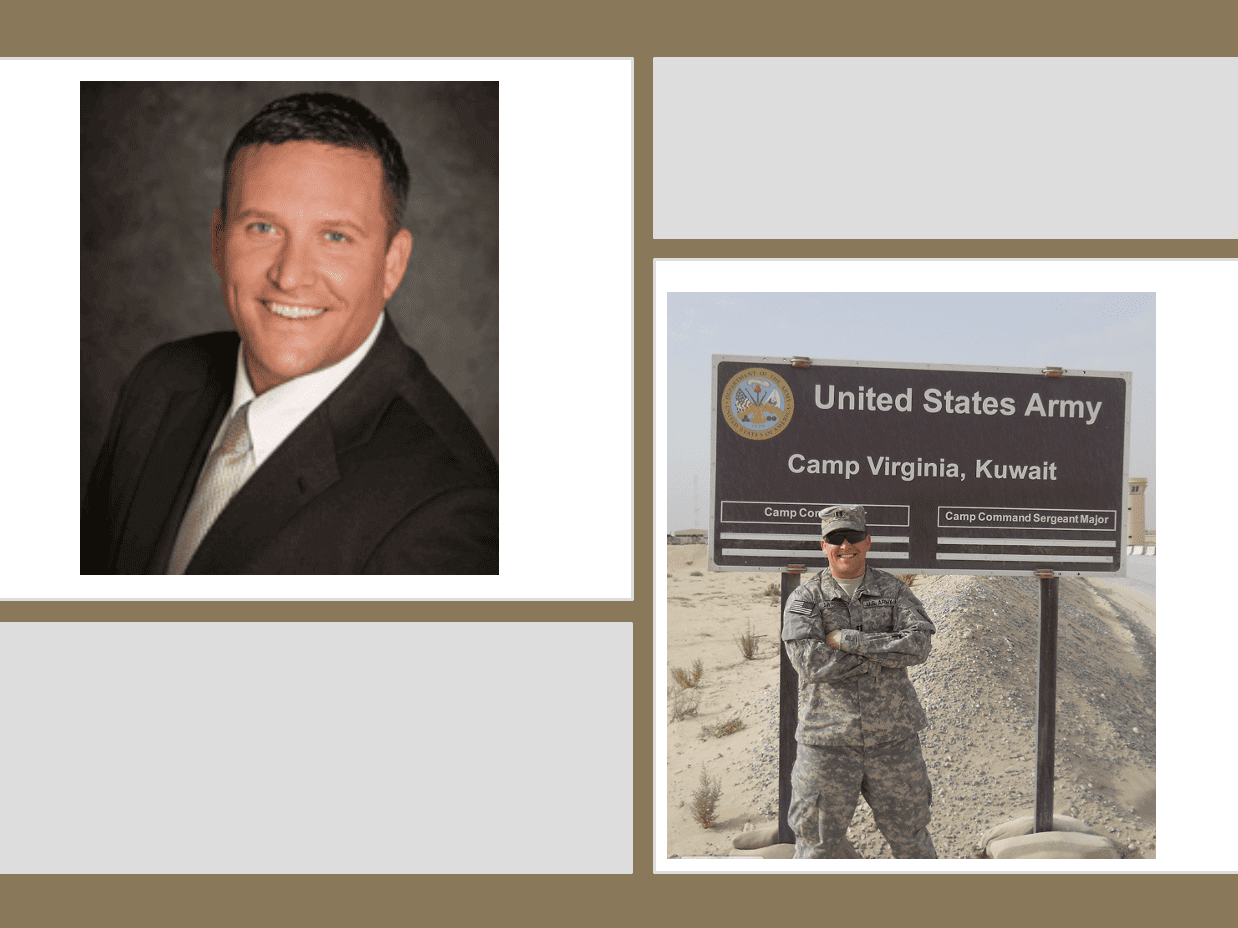

Peter Lawrence, proprietor of Lawrence Insurance coverage Company, says this state and even this area are contributing components relating to why insurance coverage charges proceed hovering and why it is sensible to examine your insurance policies extra usually.

“I’ve been on this enterprise for a very long time and personally witnessed what some corporations have carried out to both reject claims or skimp on companies and/or elements for broken automobiles to place extra money on their very own coffers,” mentioned Lawrence, who started his firm on March 1, 2008, after a stint within the U.S. Military, reaching the rank of Main. “There may be plenty of insurance coverage fraud on this state between private damage suites and restore retailers that brazenly promote to have the deductible taken care of. The entire individuals’s charges enhance when claims are submitted and processed.”

So, it actually doesn’t shock him when somebody within the state is paying between $1,500 and $1,800 per yr on an auto coverage with full protection and better legal responsibility limits. Different elements of the nation might pay as little as one-third of that yearly due to the place they stay (climate and inhabitants density) and the decrease variety of fraudulent claims.

“The state minimal auto insurance coverage requirement is 25/50/25,” he continues. “Which means $25K per individual for bodily damage, as much as $50K per accident and $25K for property injury. These limits don’t go too far in an at-fault accident in immediately’s economic system. The remainder is out of pocket.”

The company is a full-service enterprise that tackles each private and business shoppers.

On the private facet, they ranges from valuables like jewellery and houses to vehicles and artwork or collectibles. Lawrence works with a number of carries corresponding to The Hartford, Liberty Mutual, Nationwide (the place Peter started his profession after the Military in 2008) and a number of other different carriers to not solely present one of the best charges, however the proper protection as properly.

Having the liberty to buy round offers prospects extra choices on quotes, and reviewing numbers from 4 corporations as a substitute of only one provider makes good enterprise sense and assures what’s going to work finest from the consumer’s standpoint.

An inventory of valuables may embody costly “toys” corresponding to bikes, boats, snowmobiles and different leisure automobiles and actions. Lawrence says many individuals are misinformed on the subject of correctly insuring that classification, particularly in the course of the off months or if you find yourself away out of your driveway. “Some individuals falsely consider they’ll eradicate the protection as soon as the season ends. Your registration will get suspended for greater than a 30-day lapse in protection. As a substitute of reducing their protection between the winter months after they aren’t utilizing these objects, after which flipping again within the spring, they’ll save on the hassles of re-registering their exercise automobiles and the extra cash that comes with opening up a brand new coverage,” he mentioned.

The company’s five-person workers works on creating sources for all strains of insurance coverage, together with business legal responsibility employee’s compensation, worker advantages and extra. Lawrence sees his firm’s philosophy being full service and capable of deal with most conditions and desires.

Eating places are of explicit significance to him. They’ve been hit exhausting by the pandemic. Some have been devastated. They provide a product to assist insulate enterprise homeowners from additional monetary loss. “There are too many situations that may flip a good firm into one which turns the other way up,” Lawrence mentioned. He works with every consumer to make sure they’ve the right solutions and decisions to mitigate undesirable or unexpected circumstances.

“When an insurance coverage declare will get submitted, there are possibilities for one thing to fall by way of the cracks. We help with establishing and following up in your declare to be sure you get a world-class expertise and, most significantly, you might be made as complete as doable once more,” he mentioned.

Wanting ahead to 2022, Lawrence mentioned he would love to attach with small enterprise homeowners—particularly new homeowners—who need to talk about their insurance coverage choices. He opinions every coverage to verify the client is aware of what they’re paying for and are insured for what they genuinely want.

He does the identical for property homeowners, be it householders, condos, multifamily rental, these proudly owning trip properties, or anybody who could also be dissatisfied with their present insurance coverage supplier. It’s time to reassess these reconstruction values, and it is a good time to evaluation.

The Lawrence Insurance coverage Company is situated on 872 Smithfield Ave., in Lincoln. They’re open Monday by way of Friday from 8:30 AM till 5:00 PM, Saturday by appointment, and closed on Sunday.

For extra particulars concerning the company or to schedule a free, no obligation session, please contact Peter Lawrence at 401-726-3210 or e mail him at [email protected].

Additional particulars could also be discovered by visiting their web site at www.lawrenceagencyinc.com.