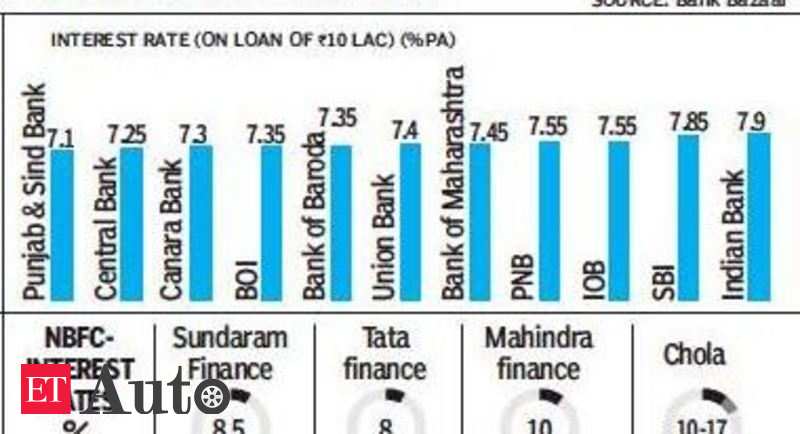

CHENNAI: NBFCs are dropping market share to banks in automobile and SUV financing and are shifting their focus to used automobiles, two-wheelers and industrial automobiles as a substitute. A mixture of capital constraints amongst NBFCs and renewed aggression from public sector banks (PSBs) has led to this example, mentioned auto financiers. In a bid to develop their retail portfolio, PSU banks are providing auto loans at 7.25% to 7.7% in comparison with NBFCs whose charges vary from 8.75% to 11%.

Whereas State Financial institution of India (SBI) is providing auto loans ranging from 7.7%, others are even cheaper with Central Financial institution of India providing loans at 7.25%, adopted by Canara Financial institution

(7.3%), United Financial institution of India

(7.4%) and Indian Abroad Financial institution (7.55%). “In current occasions, NBFCs have misplaced market share to PSU banks, which have grow to be extra aggressive and that features Tata Motor Finance,” mentioned Tata Motors group CFO P B Balaji. In contrast to banks, NBFCs depend on wholesale funds. Banks are actually going sluggish in lending to finance corporations with RBI encouraging banks to take the co-lending mannequin to make the most of NBFCs’ community.

In accordance with M Ramaswamy, chief monetary officer at Sundaram Finance, banks are flush with liquidity and may carry down charges. “We face strain in some markets, relying on how aggressive they flip. It’s a blended bag for us — we principally cater to people with increased threat profiles and due to our good scores, our value of funds has additionally come down. So, in sure areas, now we have misplaced market share and in others, now we have gained,” he mentioned.

Sundaram Finance noticed a 20% hole in mortgage disbursements within the September-ended quarter, 2020. Cholamandalam Funding & Finance Firm (CIFC) noticed complete disbursements decline by 30% year-on-year in its automobile finance section for the quarter-ended September 2020, in response to analysis reviews of brokerage agency Motilal Oswal. This excludes the tractor and development gear (CE) segments.

Shriram Transport Finance disbursed ₹650 crore of loans, which was half of final yr. Additionally, 97% of disbursements had been within the used automobile section. “Our focus is on particular person and small truck house owners preferring to purchase used automobiles. Usually, banks don’t lend to used automobiles as a result of it’s time-consuming, requires automobile valuation and possession switch paperwork,” mentioned Umesh Revankar, MD & CEO, Shriram Transport Finance.