Waseem Tarabishi insists that workers at his San Diego-area collision restore store take the web lessons they should preserve their technical certifications whereas on the clock so he can be sure that they’re paying consideration.

After shopping for CollisionTech in El Cajon three years in the past from homeowners who “didn’t know what they have been doing,” he invested $35,000 in a TruScan Stay Mapping System that may detect structural harm that in any other case would possibly go unnoticed. Common software program updates to the scanner price $1,500 a 12 months.

He additionally owns a $2,500 scanner for automobile digital programs. Common software program updates price $1,100 yearly. He pays for memberships that present common updates to collision restore manuals produced by auto producers.

Tarabishi’s effort to maintain up with expertise has earned him a five-star customer-satisfaction score on Yelp and a Gold Class designation by the Inter-Trade Convention on Auto Collision Restore. He stated the I-CAR certification is virtually necessary if he desires insurers to ship enterprise his approach, however it’s not all the time a pleasure to work with them.

“The trade is managed by the insurance coverage carriers,” he stated. “I name them mafia.”

Tarabishi stated his dim view is formed by claims adjusters who push to complete jobs rapidly as an alternative of taking the time to do it proper. He stated carriers appear unconcerned about restore work that leaves hidden harm behind, endangering the protection of their prospects.

“They’re counting in your stupidity,” he stated. “What you don’t know saves them cash.”

Tarabishi is one among many specialists who believes that technical acumen and strict adherence to producers’ restore specs are crucial for immediately’s collision restore trade. Auto producers are utilizing new supplies to scale back automobile weight, including refined security programs and forsaking the inner combustion engine for all-electric propulsion. Technicians who as soon as relied totally on welding torches and ball-peen hammers now want the assistance of superior scanning and prognosis gear, together with on-line entry to producers’ up to date restore procedures.

Do the correct factor

Efforts to regulate prices and scale back declare cycle instances creates pressure between insurers and collision restore professionals. The usage of smart-phone apps that create photo-based preliminary restore estimates could add to that friction by fomenting overly optimistic expectations.

“How have you learnt what’s beneath there?” asks Frank Terlap, an inventor who co-founded an organization that makes calibration gear for automotive security programs and creator of a e-book titled Auto Trade Disruption.

In response to Mitchell, a San Diego-based claims administrator and information analytics supplier, 93% of automobiles on US roads at the moment are geared up with superior driver help programs, recognized within the trade as ADAS. These programs typically require recalibration after a crash.

Terlap stated trade information reveals that collision restore retailers aren’t performing practically as many calibrations as they need to. Mitchell reported final September that solely 8.5% of claims for restore to automobiles within the 2018 to 2020 mannequin years generated the road merchandise that signifies an ADAS calibration was carried out. Terlap stated the overwhelming majority of late mannequin automobiles require a calibration after a collision, but the insurance coverage trade has no measures in place that guarantee the entire work that must be finished after a collision is completed.

Maybe for good cause. Terlap stated ADAS calibrations can add $300 to $2,000 to the price of restore.

Terlap stated a lot of the stress between insurers and collision repairers dates to the creation of direct restore packages, the place work finished at physique retailers that belong to an insurer’s community. He stated insurers inform the restore retailers what they are going to pay for and what they gained’t, so work that’s required based on the producer’s specs may not get finished if it’s not included within the insurer’s DRP settlement.

Producers, alternatively, are keenly considering correct restore procedures. They know from market analysis that prospects who’re sad after a collision restore are more likely to exchange their automobile with one other model, he stated. That’s why some producers are forming partnerships with insurers and steering enterprise to restore retailers which might be “licensed” to work on their automobile manufacturers.

“The trade desires to do the correct factor. It’s simply catching up,” Terlap stated. “The issue, although, is the automobiles are altering so quick.”

Mitch Becker, director of coaching for Professional-Tech Automotive Options, stated many ADAS sensors are connected to automobile windshields. Becker stated 14 million windshields are changed yearly within the US. Due to ADAS, what was once a comparatively easy restore job now takes for much longer.

“The common windshield declare in the US has greater than doubled,” Becker stated.

Becker stated the addition of ADAS programs into windshield design requires an actual calibration that may be finished solely inside a physique store, not less than if the producer’s specs are adopted. Becker stated think about an ADAS sensor emits a laser beam geared toward a goal the dimensions of a bank card. If the angle of the laser is shifted one diploma, at a distance of 150 meters that beam will probably be aimed into the adjoining site visitors lane, pointing into oncoming site visitors.

Becker stated he is aware of of technicians who suppose they will skip the calibration course of by leaving the ADAS gear related when the windshield is eliminated. “Nothing may very well be farther from the reality,” he stated.

Devices can’t be correctly calibrated and not using a check drive, he stated. ADAS sensors are geared toward particular targets — the lane marker on the fringe of the highway or the automobile immediately in entrance. Freeway journey is important to make sure they’re calibrated. Usually, the climate doesn’t cooperate. For instance, snow could obscure the site visitors lanes that function cues for lane-departure warnings.

“We’ve had automobiles that we needed to drive 70 miles to get the system calibrated once more,” Becker stated.

Even because the job of auto physique restore turned extra technical, vocational colleges are dropping coaching packages as a result of it’s too costly to maintain up with expertise, Becker stated. The result’s a scarcity of a talented labor, which explains why Becker’s employer operates its personal faculty. Even skilled technicians want persevering with training as expertise advances.

“You’re by no means finished with faculty,” he stated.

Becker stated autobody restore technicians are usually anticipated to carry their very own instruments to the job, and the price of instruments is usually a barrier to entry within the subject. He stated the time it takes to study the job will also be daunting. Becker stated it takes not less than two years to study the commerce.

“The businesses are battling over the people who find themselves on this trade as a result of there will not be sufficient,” he stated.

Frequency down, severity up

Trade specialists verify Becker’s observations.

Susanna Gotsch, an auto insurance coverage analyst for CCC Data Companies, stated in a Jan. 11 report that fifty% of all automobiles manufactured from 2017 to 2020 have computerized emergency braking programs that require “difficult diagnostics.”

Gotsch stated ADAS is contributing to a long-term pattern of declining claims. She stated in 2019, CCC noticed a 0.2% decline in non-comprehensive declare counts, which incorporates each repairable and whole losses. Final 12 months these claims have been down 24%, largely due to distant work assignments and social distancing measures associated to COVID-19.

On the identical time, ADAS programs are rising the price of repairable claims. Gotsch stated earlier than the pandemic, claims prices have been rising by about 3% to 4% yearly. She stated a mix of extra extreme accidents and extra automobile expertise spurred claims prices to rise by 5% to six% in 2020.

“The brand new applied sciences like ADAS, light-weight supplies, extra prices for issues like automobile scan and calibration are largely behind the rise in restore prices,” she stated in an e mail.

Larger used automobile prices are additionally driving declare prices. Gotsch stated CCC expects whole loss claims to leap from 5-6% for the complete 12 months 2020, though a lot bigger will increase have been seen through the second half the 12 months after the Bureau of Labor Statistics elevated the buyer worth index for used automobiles by 11 factors.

As a result of immediately’s automobiles last more and automobiles are older, on common, than they was once, the complete affect of ADAS on declare frequency has not been absolutely felt. Grotsch stated fewer than 20% of registered automobiles are geared up with the ADAS programs which were proven to have probably the most efficacy in lowering declare counts, akin to blind-spot monitoring, entrance and rear computerized emergency braking and ahead collision warning.

Gotsch stated the rising use of expertise in automobiles forces restore retailers to spend money on instruments and coaching which might be particular to particular person producers. She stated repairers are having to make selections about the place they need to specialize.

Insurers pay for 89% of collision restore prices, based on CCC. More and more, repairs are being finished via direct restore packages. Gotsch stated DRPs made up 41.9% of repairable value determinations through the first 10 months of 2020, up from 37.4% in 2018.

An rising variety of direct restore program value determinations are carried out by nationwide multi-shop organizations (MSOs) and fewer are being carried out by unbiased retailers. Gotsch stated MSOs carried out 37.6% of value determinations in 2020, up from 5.8% in 2000. The share of value determinations carried out by unbiased retailers declined to 51.3% from 85.3% throughout that interval.

“The big MSO’s, franchises, and dealership teams in lots of instances are rising their variety of areas and the markets they serve, and subsequently are seeing their share of the market develop,” she stated.

All-electric future

Basic Motors is betting that the rising recognition of electrical automobiles won’t be a fad. On Jan. 28, America’s largest automobile builder introduced that it plans to grow to be carbon impartial by 2040 and eradicate tailpipe emissions from new light-duty automobiles by 2035.

“Our plans are an all-electric future and we’re shifting very aggressively on that entrance,” stated John Eck, collision supervisor for Basic Motors, throughout a January webinar sponsored by the Collision Trade Digital Commerce Affiliation.

That’s a protracted voyage. In response to the U.S. Division of Power, 1.44 million plug-in electrical automobiles have been offered within the US from 2010 via 2019. Even when all of these automobiles are nonetheless on the highway, that represents a small fraction of the 276 million registered automobiles within the US.

However the expertise has been advancing quickly and electrical automobiles are anticipated to overhaul the inner combustion engine as the first methodology of propulsion in 10 to twenty years.

In a January 2020 report, Boston Consulting Group projected that electrical automobiles will take a 3rd of the worldwide car market in 2025 and 51% by 2030. That projection contains plug-in hybrid automobiles with inside combustion engines, however BCG expects hybrids to fade in market share as battery-electric automobiles acquire dominance.

Globally, passenger electrical automobile gross sales jumped from 450,000 in 2015 to 2.1 million in 2019, BloombergNEF stated in a report final Could. The COVID-19 pandemic slowed the sale of electrical automobiles in 2020 together with all different automobiles, however BloombergNEF stated the trade will get better together with the economic system will make up 58% of latest passenger automobile gross sales by 2040.

The rising use plug-in electrical automobiles powered by batteries is including one other layer of complexity to collision repairs.

Batteries packs massive sufficient to energy automobiles are heavier than inside combustion engines, so producers shave weight by constructing auto our bodies out of light-weight supplies metals, akin to ultra-high-strength metal and carbon fibers, that require totally different sorts of instruments.

The batteries themselves current challenges. A collision can set off a chemical response, referred to as a thermal runaway, among the many battery cells that may proceed burning or reignite after being doused with water, based on report final month by the Nationwide Transportation Security Board. Restore technicians who break right into a wrecked electrical automobile can obtain a deadly shock by the high-voltage power saved within the batteries.

An article revealed in December by Mitchell stated elements on electrical automobiles akin to hoods and fenders are changed, fairly than repaired, extra typically than with gasoline-burning automobiles. Electrical automobiles typically should be scanned extra typically and exhibit extra flaws when they’re scanned, based on the report by Mitchell Director of Claims Efficiency Ryan Mandell.

Mandell stated estimates for electrical automobile collision repairs embody a diagnostic scan 49.6% of the time, in comparison with 38.6% for typical automobiles. Whereas late-model gasoline automobiles are scanned virtually as incessantly as electrical, the scans which might be carried out reveal extra faults with electrical automobiles. Mandell stated electrical automobiles produced a median 12.6 fault codes per scan, in comparison with 8.5 for internal-combustion engine automobiles.

Electrical automobile producers use extra light-weight supplies akin to aluminum, ultra-high power metal composites and carbon fiber when constructing automobiles. Mitchell information reveals elements constituted of such supplies usually tend to require alternative fairly than restore. Quarter panels, for instance, are repaired 83.2% of the time for internal-combustion automobiles, however 74.6% of the time for electrical automobiles.

Repairs additionally take longer. Particularly, Mitchell discovered that electrical automobile collision repairs required 27.4 hours of labor in comparison with 23.3 hours for internal-combustion automobiles.

“EVs really are a distinct breed—one which comes with a singular set of necessities and exemplifies the modifications in automobile complexity seen over the previous decade,” Mandell wrote.

Marcial Nuno, the supervisor of CollisionTech in El Cajon, stated he’ll in all probability be retired by the point electrical automobiles take over roadways.

He entered the commerce within the 1980’s after two semesters of coaching. These days, he stated, technicians go to highschool for 2 or three years.

Regardless of. Nuno stated like every part else, on-the-job expertise is what issues. “You’ve heard about 10,000 hours?” he requested.

Nuno has that a lot and extra. After studying the restore commerce, he labored 11 years as an appraiser for insurance coverage carriers. In reality, that have landed him his job managing Tarabishi’s store.

Nuno stated he spends a few hours each different week or so taking on-line lessons to maintain up with is I-CAR certifications. He stated the auto-collision commerce has modified quite a bit through the years, however one factor stays the identical.

“It’s important to continue learning,” he stated. “It’s solely upgrading your data.”

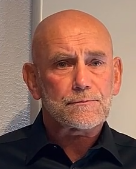

In regards to the picture: Waseem Tarashibi factors out an ADAS sensor on the entrance bumper of a BMW at his store, CollisionTech, in El Cajon, Calif. He stated such particulars will be simply missed if collision repairers don’t comply with producers’ protocols. Picture by Jim Sams.